Family Pricing: Invest individually and benefit collectively

Investing makes sense on its own, but even more so when you can benefit from lower fees together with people close to you. With the new “Selma Family” feature, you can now combine your investment amount with selected individuals so that you can achieve a lower fee level together as a Family.

What is Selma Family?

Selma Family is a feature that allows you to pool your invested assets at Selma with other Selma users. The aim is to reach a lower fee tier more quickly together and thus pay lower fees.

In the traditional fee model, you automatically benefit from lower percentages the more you invest. For example, the annual fee is currently:

- 0.68% with under CHF 50’000

- 0.55% from CHF 50’000

- 0.47% from CHF 150’000

- 0.42% from CHF 500’000

With Selma Family, not only your own total is taken into account, but also that of your selected family members. This makes it easier for you to reach a lower fee level.

How exactly does Selma Family work?

You and the people you add to your family pool your invested sums. This creates a common basis for calculating the fee level.

Of course, you all retain your own investment accounts with their individual investment strategies and portfolios.

An example:

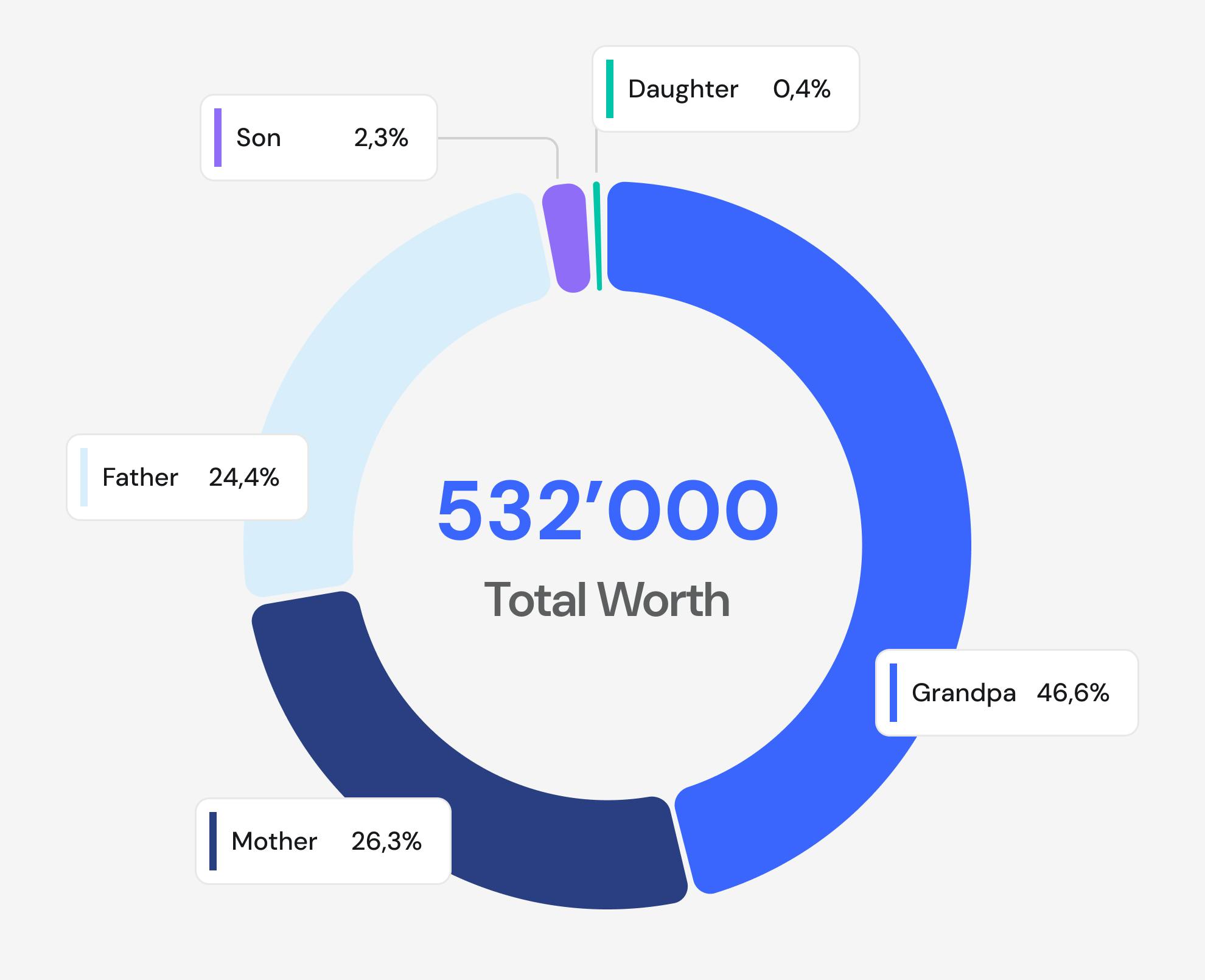

Imagine the following family:

- 👴 Grandfather, retired: CHF 248,000 invested with Selma

- 👨 Father, employed: CHF 130,000 invested with Selma

- 👩 Mother, employed: CHF 140,000 invested with Selma

- 👧 Daughter, student: CHF 2,000 invested with Selma

- 👦 Son, employed: CHF 12,000 invested with Selma

Individually, they would all fall into different fee categories – some higher, some lower. But together, they have a total assets of:

👉 248,000 + 130,000 + 140,000 + 2,000 + 12,000 = 534,000 CHF

This automatically puts the entire family in the 0.42% fee level, which normally only applies to investors with an investment amount of CHF 500,000 or more.

This means that:

Everyone pays a lower fee. Even the daughter with only CHF 2,000 and the son with CHF 12,000 immediately benefit from the lowest fee rate, which would be very difficult for them to achieve on their own.

Who can be part of the Family?

The Selma Family does not have to be biologically related. Anyone with whom you share a common financial goal can be part of it:

- Parents or siblings

- Partner or friends

- Colleagues or anyone else you want to join forces with

👉 FAQ about the feature: Click here for the detailed FAQ article.

How do you invite others to join your Selma Family?

To help your family grow and benefit from your combined assets, you can easily invite additional people to join. Management is handled directly in the Selma app for iOS and Android and is designed so that anyone can join in just a few seconds.

How to start your family

You can find this feature in your profile under the Pricing tab in the Family section. There, you can:

- Create a new Family

- Assign a name

- Invite people to join

Two easy ways to invite someone

There are two options available to you:

- Share invitation link:

Each Family receives a personal link that you can share via Messenger, email, or text message, for example. - Show QR code:

Alternatively, you can display your personal QR code directly in the app—the other person simply scans it with their smartphone and they can join right away.

Once the link or QR code is opened, all that's left to do is confirm the invitation.

If the person doesn't have a Selma investment account yet, they'll need to create one first, and then they can join your Family right away.

👉 You can find detailed information in the FAQ article.

🔔 Important: Each person can only be in one Family at a time. If you're already in a group, you'll need to leave it before you can join another one.

Rule

Why is the Selma Family worth it?

Fees can have a big impact on your long-term returns: the lower they are, the more stays in your portfolio and can work for you. Selma Family makes this savings potential accessible to groups of investors—without each person having to invest large sums individually.

What's more, it brings a social element to investing. Working together toward goals can be motivating and make the path to financial freedom a little easier.

Conclusion: Making investing smarter together

With the Selma Family, Selma is taking another step toward making investing not only more personalized, but also more rewarding for the community. If you've always wanted to work on your financial future with friends or family members, this feature is a powerful tool for doing just that.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn