Wealth Manager Comparison Switzerland 2026: Costs, Net Returns and Rankings

When it comes to investing, many people in Switzerland turn to professional wealth managers for guidance and structure. The expectation is clear: a sound strategy, disciplined execution and long-term stability. But are all providers truly delivering on that promise?

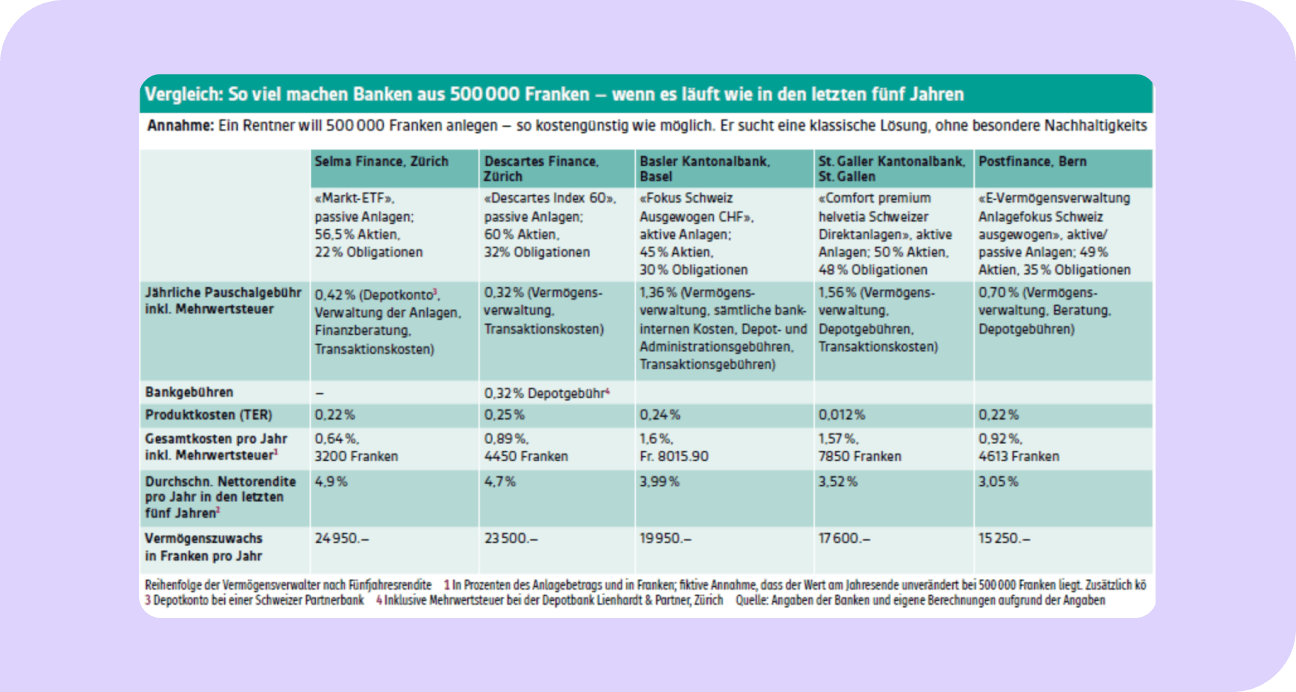

A recent independent comparison by the Swiss consumer magazine KGeld (February 2026) reveals significant differences between banks and digital wealth managers in costs and net returns — and shows where investors retain more of their wealth over time.

Result: 🏆 Selma Finance ranked first.

The core question: Who invests CHF 500,000 most effectively?

At the centre of the KGeld comparison is a scenario familiar to many retirees in Switzerland: receiving a pension fund lump sum and investing CHF 500,000. It is a significant amount — yet entirely typical when accumulated retirement savings are paid out.

In fact, 45% of people in Switzerland withdraw their occupational pension as a lump sum. On average, this amounts to CHF 280,210 — capital that often needs to last for 20 years or more.

The objective is not to maximise short-term returns, but to invest the capital in a disciplined and cost-efficient manner over the long term while keeping risk at a manageable level. In retirement, the focus shifts away from speculation and toward stability, predictability and financial peace of mind.

Importantly, the comparison was not designed to reward short-term performance, but to assess how costs and net returns influence long-term outcomes under consistent conditions.

Keep in mind

CHF 500,000 is simply the example used in the comparison. The impact of costs and returns follows the same logic — whether you start with CHF 5,000, CHF 50,000 or CHF 500,000.

The providers: Banks vs. digital wealth managers

To place this scenario in a realistic context, the independent financial magazine KGeld conducted a direct comparison. The analysis included comparable offerings from leading traditional banks and digital wealth managers in Switzerland that are suitable for a balanced investment of pension fund capital.

Digital wealth managers

Selma Finance (Zurich)

Descartes Finance (Zurich)

Banks

Zürcher Kantonalbank (Zurich)

Basler Kantonalbank (Basel)

St. Galler Kantonalbank (St. Gallen)

PostFinance (Bern)

Migros Bank (Zurich)

Raiffeisen

Bank Valiant (Bern)

Banque Cantonale Vaudoise (Lausanne)

Keep in mind

The comparison included leading Swiss providers offering comparable solutions suitable for the scenario described above.

The methodology: How the comparison was structured

To ensure meaningful results, all providers were evaluated under the same conditions: an identical investment amount of CHF 500,000, a balanced risk profile and a focus on Swiss assets.

Differences in product names or marketing presentation were not relevant. What mattered was how costs, investment strategy and structural setup impact long-term outcomes.

Keep in mind

Since no one can predict future market developments, the comparison was based on the average returns of the past five years. This allows the providers to be assessed retrospectively under consistent and comparable conditions.

The results

The ranking was based on three key criteria: annual total costs, average net return and the resulting annual increase in wealth for an investment amount of CHF 500,000.

🏆 1st place: Selma Finance

Annual total costs: 0.64%

Average net return: 4.9%

Annual increase in wealth: CHF 24,950

2nd place: Descartes Finance

Annual total costs: 0.89% (CHF 4,450)

Average net return: 4.7%

Annual increase in wealth: CHF 23,500

3rd place: Basler Kantonalbank

Annual total costs: 1.60% (CHF 8,016)

Average net return: 3.99%

Annual increase in wealth: CHF 19,950

4th place: St. Galler Kantonalbank

Annual total costs: 1.57% (CHF 7,850)

Average net return: 3.52%

Annual increase in wealth: CHF 17,600

5th place: PostFinance

Annual total costs: 0.92% (CHF 4,613)

Average net return: 3.05%

Annual increase in wealth: CHF 15,250

6th place: Banque Cantonale Vaudoise

Annual total costs: 2.17% (CHF 10,886)

Average net return: 2.75%

Annual increase in wealth: CHF 13,750

7th place: Bank Valiant

Annual total costs: 1.68% (CHF 8,423)

Average net return: 2.43%

Annual increase in wealth: CHF 12,150

8th place: Migros Bank

Annual total costs: 1.32% (CHF 6,623)

Average net return: 2.2%

Annual increase in wealth: CHF 11,000

9th place: Raiffeisen

Annual total costs: 1.45% (CHF 7,256)

Average net return: 2.2%

Annual increase in wealth: CHF 11,000

10th place: Zürcher Kantonalbank

Annual total costs: 1.50% (CHF 7,500)

Average net return: 1.67%

Annual increase in wealth: CHF 8,350

Key takeaways from the comparison

The results clearly demonstrate how strongly costs and net returns influence long-term outcomes. Under identical conditions, the difference between first and tenth place amounts to more than CHF 16,000 per year.

Three central insights emerge:

- Banks are not independent wealth managers.

In many cases, proprietary — and often more expensive — in-house products are used. - Costs are not a minor detail.

Even differences of a few tenths of a percentage point can have a meaningful impact year after year when investing larger sums. - Net return matters more than gross return.

What ultimately counts is not the advertised return, but what remains after all fees. - Comparison is especially important in retirement.

Investing pension fund capital is a long-term decision — and small differences can compound into substantial amounts over time.

The full article can be read here (only available in German).

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn