How Selma's Pension Mode helps you stay on track

Retirement comes with many important financial decisions. One of them is the option to withdraw your pension fund as a one-time lump sum. How you invest that money afterwards can have a big impact on your financial security throughout retirement. At this stage of life, your investment strategy should look different than it did in your 20s. Your investment horizon is shorter, and taking less risk becomes more important. At the same time, your financial flow changes: instead of regularly putting money into your portfolio, you now need to withdraw money every month - almost like receiving a salary - to cover your daily expenses. That's exactly why we developed Pension Mode. It automatically adjusts your investment strategy, reduces risk, and enables stable, flexible payouts. In this blog post, you'll learn what changes with Pension Mode, whether it’s the right fit for you, and how you can activate it.

What is Selma's Pension Mode

If you're approaching retirement or already enjoying it, your financial needs are shifting. That’s exactly where Selma's Pension Mode comes in. This smart feature is tailor-made for people entering this new life stage. It automatically transitions your investment portfolio to a more stable, lower-risk strategy with a strong Swiss focus. Sounds like a solid plan? It is.

Instead of chasing high growth, your strategy now focuses on steady income, smart risk management, and the flexibility to withdraw money when you need it. Think of it as your portfolio adjusting to work for you — helping you draw from your pension capital while still staying invested.

Pension Mode is designed to give you peace of mind in retirement: lower risk, more stability, and the comfort of knowing your money is working to support your lifestyle.

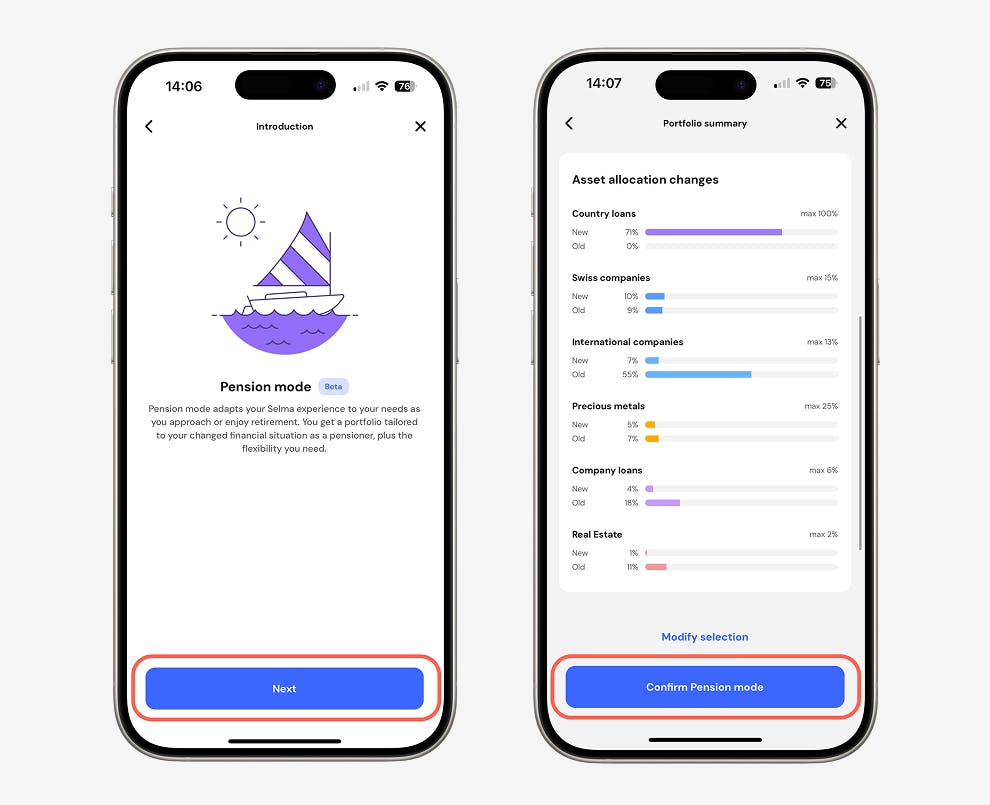

What changes when I activate Pension Mode?

As you get older, your ability to take on risk usually decreases. Pension mode reflects this and your shorter investment horizon by adjusting your portfolio automatically. Pension mode includes features designed to reduce risk and give you peace of mind in retirement.

- Allocation:

The asset focus in your portfolio will change from growth-focused to

more stable, lower-risk investments. - Swiss Bias:

Since your expenses are in Swiss francs, it makes sense for your investments to be too. Pension mode increases your CHF exposure (currently a required setting). This helps protect your money from currency fluctuations. - (Optional) Dividend and interest-focused Income portfolio:

If you want regular payouts without having to sell investments, Selma's dividend portfolio might be right for you. You can read more about the Income portfolio here.

Who is the pension mode for

This mode is ideal for individuals who:

- Are retiring or within a few years of retirement:

Once you begin drawing from Pillar 3a or pension savings, preserving capital and generating stable returns becomes crucial. - Have opted for a lump-sum withdrawal:

Those choosing to withdraw pension funds as capital rather than as an annuity take on the responsibility of managing their investments. Pension Mode helps ease this by automating income distribution and market-adjusted asset allocation. - Want flexibility with withdrawals:

Selma supports both regular and on-demand withdrawals without fees or harsh restrictions. Perfect for retirees seeking control and convenience.

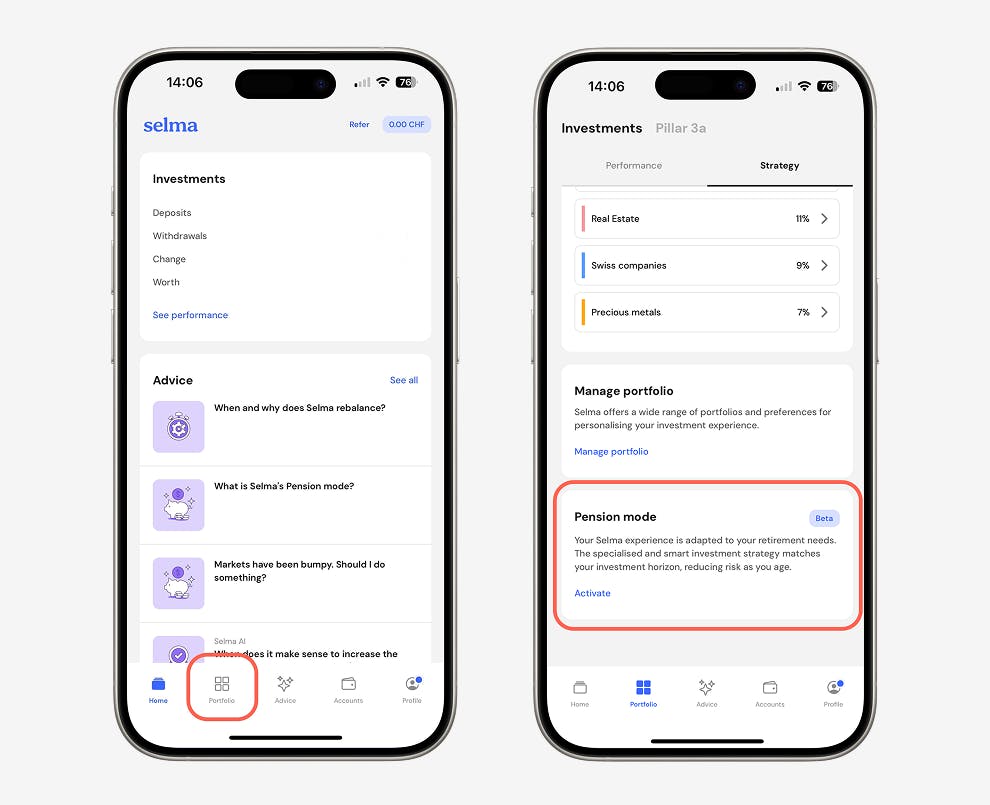

How can I activate Selma's Pension Mode

You can enable or disable this feature through the mobile app:

- If you're not yet a Selma client, you'll need to download the app, register and open an investment account first.

- Go to Portfolio > Strategy > Pension mode.

- Press Activate.

- Follow the steps! Selma will guide you through a quick profile update and allow you to customise your portfolio.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn