When is the best time to invest?

Investing is simple, right? Buy at low prices and sell at high prices? If only it were that straightforward!

But how about today? Ukraine, Inflation, Climate Change, all those rocky times cause nervousness. The markets went down over the last couple of days. Should you be worried, or is this a great time to start?

If you want to invest for the long-term, the answer is easy: Now, is always better than later.

Why is now the best time?

This article could have ended right here, but we want to explain further.

Never listen to self-proclaimed wall street gurus and don’t let your emotions & the media lead your decision on when you should start to invest. Reason & facts are the only things you should go for.

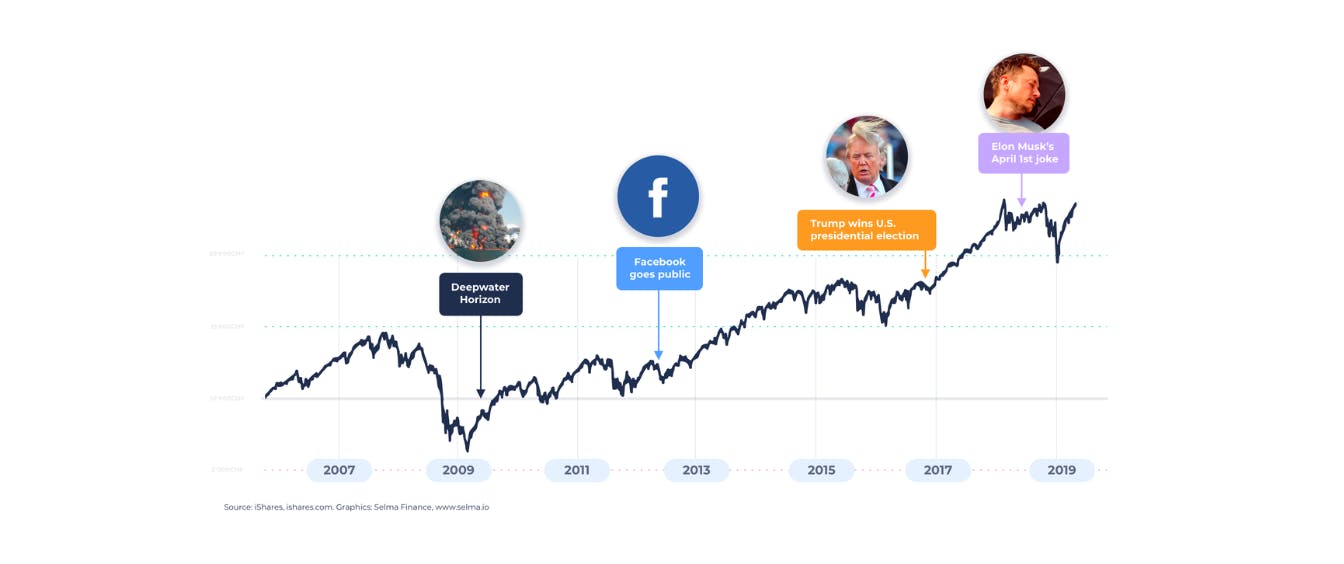

First, it is important to understand why waiting for the exact "right timing" shouldn't concern you too much. Let's have a look at events that influenced the global market and put them into context.

- Apr 2010 – Deepwater Horizon oil tanker sunk

- May 2012 – Facebook went public

- Nov 2016 – Trump won the presidential election

- Apr 2016 – Elon Musks April fool's joke about Tesla being bankrupt

This example uses the iShares MSCI World ETF in order to approximate the MSCI World Index. It represents how a specific mix of big global companies did during the last 10 years on the stock market.

3 reasons why today is a great day to start

Here are the main three things you should take away from this chart

1. Markets went up, long-term 😊

For a long time, the global market is consistently growing. Even plunges get evened out rather quickly within a couple of years.

2. No panic! 👍

“Big” things happened – heavy rumors, turmoils, even bankruptcies – they all influenced the stock market but did not send the markets spiraling down forever.

3. It’s all about the mix

If you go for single company stocks, you bet on one or only a few companies performing very well. Your money depends on the profit of these few companies you picked – turning your investment choice very much into gambling. A broad mix of diverse investments definitely helps to spread your risk.

Summing up

No matter which event made stock markets drop, the dystopian future usually didn't come true – the markets recovered.

In the past, it always paid off to keep cool. No crisis lasts forever, but by starting or continuing to invest when market prices dropped, you get a better long-term investment return.

Time in the market always beats timing the market.

Tips to get started

...with our 3 main tips, you should consider when investing.

1) Less gambling, more diversification

Rather than picking only single stocks, choose diversified investments. A good way to do so is ETFs (Exchange Traded Funds).

ETFs include many different companies and are therefore said to “spread your risk ”. This means, that by investing in an ETF you give your money to companies around the world (Apple, Johnson & Johnson, Netflix, Toyota, Allianz, and many more, depending on the products you choose).

2) Dollar-Cost-Averaging aka investing step by step

Invest monthly in order to get the best out of “Dollar-Cost-Averaging”, and reduce the risk of buying everything for high prices.

3) Take the risk you can take

Do you have a good income and a huge cash buffer? Or did you just start your first job and want to invest your first savings? Choose a way of investing that suits your situation.

Selma could be a fit for you. Try Selma for free and get your personalized investment plan. Selma keeps an eye on the financial market and manages your investments automatically for you.

Carina Wetzlhütter

Carina makes technology understandable. She joined Selma to help explain finance in a more human way. Winter being her favorite season, she loves ❄️ and 🎿.

LinkedIn