ETF savings plan: Everything you need to know

In today's fast-paced financial world, the term "ETF" has become synonymous with smart investing, especially in Switzerland. But what exactly is an ETF, and why is it becoming an essential part of a savvy investor's savings plan? Let's dive in.

Did you know that only about 24% of Swiss individuals invest in ETFs? According to a study, millennials even prefer going to the dentist over visiting a bank advisor. That's why we've created this guide. You'll discover everything you need to know about ETFs: their advantages, disadvantages, expected returns, tips for getting started, and how to set up your ETF savings plan in Switzerland.

If you need assistance, we're here to help. With Selma Finance, you can create a tailored ETF savings plan in just 5 minutes. Try it out for free here.

1. ETF Definition: What is an ETF?

Let's start with the basics. An Exchange Traded Fund (ETF) is a type of investment fund and exchange-traded product, with shares that are tradable on a stock exchange. ETFs hold multiple assets such as stocks, bonds, or commodities. They aim to track the performance of a specific index, offering a way for investors to get the returns of a broad market or sector without having to buy each individual stock.

There's a vast array of ETFs out there, each representing different indices and sectors. Whether you're interested in global stocks, specific industries, commodities, or bonds, there's likely an ETF that matches your investment preference.

2. What is an ETF savings plan?

An ETF savings plan is like a regular savings account at Swiss banks. But instead of just saving money, you're putting it into the stock market. You decide on an amount to invest regularly, like every month, into your chosen ETF(s). Some providers might ask for a bigger amount at first, but then let you add as little as 1 CHF each month. This makes it feasible for those on tighter budgets to maintain consistent contributions. Such an approach facilitates diversified market investment.

Remember, an ETF savings plan is tied to the stock market, so it's different from just saving at a bank. It can earn more money, but it can also be riskier.

But here's the real charm of an ETF savings plan: its long-term perspective. Start early, invest consistently, and you can harness the power of compound interest. Over time, this can lead to significant growth, all without the stress of handpicking individual stocks. And the icing on the cake? Once you've set it up, it pretty much takes care of itself.

3. Benefits of ETFs

Investing with ETFs offers numerous advantages. Especially four advantages make them very attractive for investors.

Diversification

One of the primary advantages of ETFs is the diversification they offer. With a single ETF, investors can gain exposure to hundreds, if not thousands, of equities, bonds, or other assets.

Liquidity

Liquidity refers to how quickly and easily an asset can be converted into cash without significantly affecting its value. ETFs are traded on stock exchanges, which means they can be bought or sold throughout the trading day at market prices. Thus you can buy or sell your investments at almost any time.

Costs

Investing always costs money. It is fundamental to understand exactly what you are paying for. Generally, ETFs have lower costs compared to traditional mutual funds. This cost-effectiveness makes them an attractive option for long-term investing.

Transparency

Most ETFs disclose their holdings daily, allowing investors to see exactly what assets are inside their ETF. By looking into so called "factsheets" you will know exactly which company your money is invested in.

4. Disadvantages of ETFs

Unfortunately, there is no perfect investment. ETFs also come with a few risks and disadvantages.

You won't get rich overnight

Due to their diversified nature, while ETFs can protect against significant losses, they also might not offer the sky-high returns that individual stocks can. It's a trade-off between risk and reward.

Designed to track, not to beat the market

ETFs are designed to mimic the performance of their underlying index. This means they won't outperform the market, even if individual components within the ETF could.

Issue of control

How important is it to you to have complete control over your portfolio? Do you want to invest only in companies that you are fully convinced of? While ETFs offer diversification, this also means you might end up investing in companies or sectors you don't necessarily believe in or support.

Overwhelming selection

With thousands of ETFs available globally, choosing the right one can be daunting. In 2022 there were 8'753 ETFs globally. Each ETF follows a different strategy, tracks a specific index or covers a different industry. This plethora of options can make it challenging for investors to pinpoint the ETF that aligns best with their individual investment goals.

While ETF portfolios might not be the ticket to quick riches, they offer stability and are a recommended foundation for most investors. It's wise to have an ETF portfolio as the backbone of your investment strategy. This provides a stable base, allowing you to allocate a separate budget for exploring riskier, potentially higher-return investments.

5. For whom is an ETF portfolio the right solution?

ETF portfolios are ideal for:

- Long-term investors: Those who are looking to invest their money and let it grow over years or even decades.

- Regular investors: Individuals who want to invest a fixed amount regularly, benefiting from the power of compound interest and dollar-cost averaging.

- Diversification seekers: Investors who want a broad exposure to different markets and sectors without the need to pick individual stocks.

- Risk-conscious investors: Investors who desire broad exposure to various markets and sectors without having to select individual stocks.

It's worth noting that ETF portfolios might not be suitable for day traders or those looking for quick, short-term gains.

6. Famous ETFs and their past performance

ETF performance is linked to the index it tracks, and historical data provides some insights into what investors might anticipate. Let’s take a look at some famous ETFs:

MSCI World

The MSCI World ETF is one of the most well-known global equity ETFs. It aims to replicate the performance of the MSCI World Index. With approximately 1’600 stocks from more than 20 countries, the MSCI World offers strong diversification. However, it's important to note that there is a significant tilt towards the US market. The top companies in this ETF often include giants like Apple, Microsoft, and Amazon.

The MSCI World had an average annual growth rate of approx. 10% between December 1978 and July 2023.

MSCI Switzerland

The MSCI Switzerland ETF specifically tracks the performance of the Swiss stock market. It reflects the results of the MSCI Switzerland Index and invests in 40 of the highest-revenue companies in the Swiss stock market. This ETF offers investors the opportunity to tap into the robust Swiss economy, with top holdings often including renowned companies like Nestlé, Roche, and Novartis.

In the past 30 years, the iShares MSCI Switzerland ETF had an average return of +7% per year.

S&P 500

One of the most recognised ETFs globally, the S&P 500 ETF, tracks the performance of the S&P 500 Index. This index comprises 500 of the largest U.S. companies and covers approximately 80% of available market capitalisation. It's a go-to for those looking to gain exposure to the U.S. stock market. Top holdings in this ETF are typically major U.S. corporations like Apple, Google (Alphabet), and Facebook (Meta).

In the past 30 years, the S&P 500 had an average annual growth rate of +9% per year.

7. What performance can you expect?

It's essential to understand that past performance is not indicative of future results. While historical data provides insights, market conditions, geopolitical events, and other factors can influence the performance of ETFs. Always consider seeking advice from financial professionals before making investment decisions.

A commonly cited figure in the investment world is the "famous 7%." Many experts often reference this as the average annual return one might expect when investing in the stock market over the long term. Indeed, historical data has shown that such returns were achievable in the past. It’s crucial to approach this figure with a grain of caution. The future is unpredictable, and while 7% has been a historical average, future returns could be higher or lower.

It's also vital to understand that this 7% hasn't been a smooth, straight line upwards. The journey to this average has seen many peaks and valleys. There have been years of significant gains, but also years of notable losses. The stock market is inherently volatile, and while the long-term trend has been upward, short-term fluctuations are a natural part of the investment landscape.

In essence, while the "famous 7%" serves as a useful benchmark, it's essential to set realistic expectations, understand the inherent risks, and be prepared for the market's ups and downs. Investing with a long-term perspective and maintaining a diversified portfolio can help navigate these uncertainties and work towards achieving your financial goals.

8. Sustainable investing with ETFs

Many investors are not just looking for financial returns but also want their investments to reflect their values. This is where SRI (Socially Responsible Investing) and ESG (Environmental, Social, and Governance) ETFs come into play. These ETFs focus on companies that meet specific ethical and sustainable criteria. Whether it's companies that have a lower carbon footprint, promote gender equality, or have sound corporate governance structures, SRI and ESG ETFs allow investors to align their portfolios with their beliefs, all while reaping the benefits of diversification and liquidity that ETFs offer.

Would you like to learn more about sustainable investing options in Switzerland? Search no more.

9. Our Tips: How to Successfully Invest in ETFs in Switzerland

Now that you've taken a deep dive into the world of ETFs and their benefits, let’s take a look at what you should consider before you get started.

Build a Cash Buffer

Before diving into investments, ensure you have a safety net. Aim to save 3-6 months' worth of expenses in a readily accessible account. This buffer can support you during emergencies, preventing the need to liquidate your investments prematurely.

Diversify

One of the primary advantages of ETFs is the diversification they offer. However, don't just stop at one. Investing in multiple ETFs across different sectors and regions can further spread your risk and enhance potential returns.

Choose the right risk level

ETFs come in various flavours, from conservative bond ETFs to aggressive tech-focused ones. Understand the inherent risks of each and select those that align with your risk tolerance and investment horizon.

Invest regularly

Instead of investing a lump sum, consider a regular investment approach. This strategy, often referred to as dollar-cost averaging, allows you to spread your investments over time, reducing the impact of market volatility and potentially lowering the average cost of your investments.

Make a plan and stick to it

The financial market is inherently volatile. There will be highs, and there will be lows. Draft a clear investment strategy and stick to it. Avoid making impulsive decisions based on short-term market movements. Remember, it's not about timing the market but time within the market.

By following these guidelines and maintaining a disciplined approach, you can navigate the Swiss ETF landscape effectively, optimising your potential for growth while managing risks.

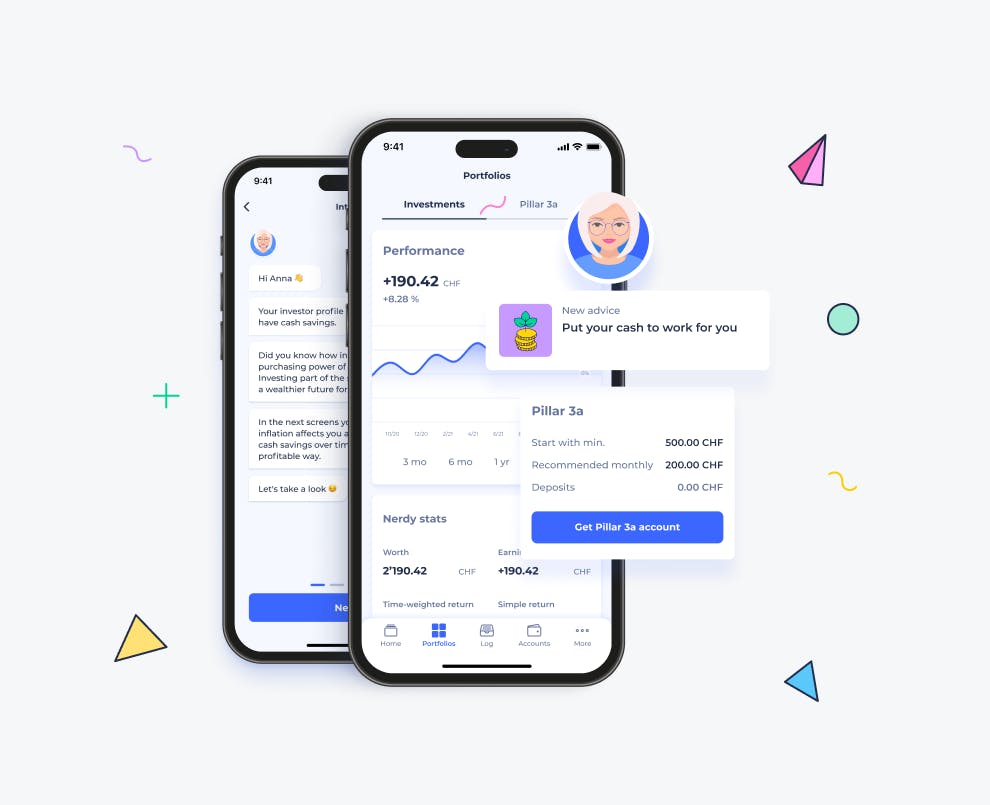

10. Selma Finance: The Smart ETF Investment Plan

Do you want to start investing but seek expert guidance to create and automatically manage a portfolio for you? Then, Selma is just right for you.

With Selma, you receive a tailor-made ETF investment plan that automatically adjusts to changes in your financial life and the financial market. Founded in 2016, Selma proudly manages the investments of over 12'000 investors today.

Here's How Selma Works:

1. Start with a chat: Simply sign up for free and engage in a 5-minute chat about your financial situation, investment aspirations, and values.

2. Get your personalized ETF Plan: Drawing insights from your chat, Selma designs a unique ETF plan tailored to your risk appetite, financial standing, and future objectives.

3. Open your account online: With just your laptop or phone and your ID, you can seamlessly set up your investment account online in under 5 minutes.

4. Sit back and relax: No need to be glued to market tickers. Selma takes charge, managing, monitoring, and adjusting your investments in response to market dynamics and any shifts in your financial circumstances.

The advantages of Selma:

Personalised solution: At Selma, we understand that every investor is unique. That's precisely why, with Selma, you receive a personalised investment plan tailored to you and your goals.

Simplicity at its best: Forget the complicated paperwork and long wait times. With Selma, starting your investment journey is a breeze. Open your account online in just 5 minutes and keep an eye on your investments via the app.

Automated yet tailored investing: After your individual ETF investment plan has been created, Selma takes the helm. Your investments are purchased for you and automatically adjusted to market changes.

Fair and transparent pricing: Selma's pricing model is based on your investment volume. Your investments are managed for a transparent monthly fee. Depending on your investment size, you'll encounter one of four rates: 0.68%, 0.55%, 0.47% or 0,42%. This all-inclusive fee structure is made possible through automation, averaging at three times less than traditional Swiss bank investment services.

Low starting amount: You can start with just 2'000 CHF. This amount is necessary in order to build a globally diversified portfolio for you.

Diversified portfolio: Selma adopts a globally diversified investment approach. Instead of limiting yourself to 2-3 ETFs, Selma offers a globally diversified portfolio that covers the entire financial market.

Sustainable investing made easy: With Selma you have an option to activate a sustainable strategy. You will still get a global diversified portfolio, however Selma makes sure your portfolio consists of ESG or SRI ETFs.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn