Nina the beginner investor – A Selma AI story

Recently, Selma AI emerged onto the scene, offering a revolutionary approach to personalised financial guidance tailored precisely to your unique needs and lifestyle. Delve into this article to explore how Selma AI can help you on your financial journey through a vivid use case.

In March 2024 Selma AI first saw the light of day with a single mission in mind: to streamline your finances and demystify the world of investing. Since then, Selma AI has helped many of our clients, and today, we want to have a concrete look at how Selma AI can make your life easier.

In order to do so, let me introduce you to Nina.

Meet Nina

Nina is a 38 year-old Senior Marketing Manager, based in Zürich, Switzerland.

Yearly income: 110’000 CHF

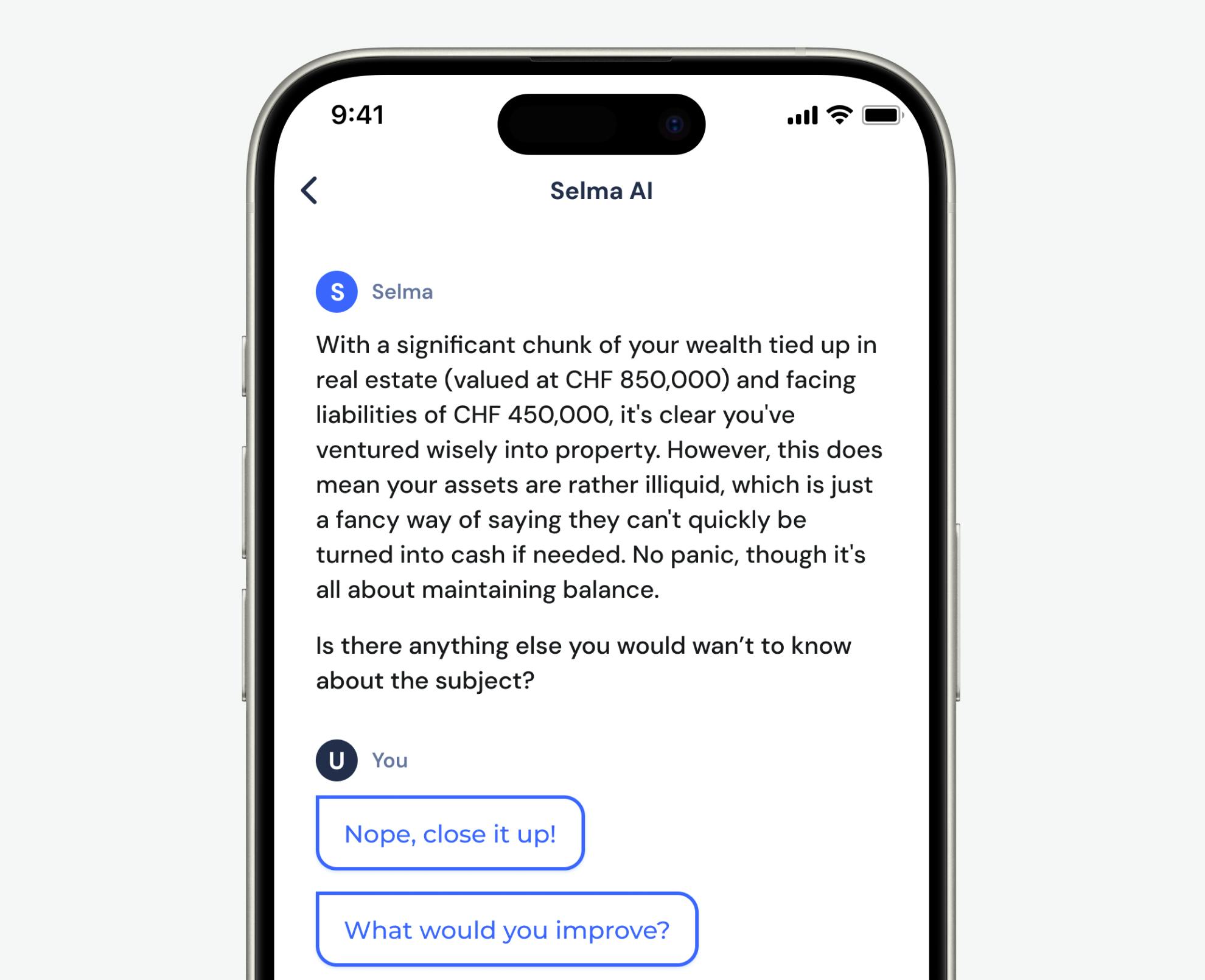

Owns real estate: 850’000 CHF

Car value: 22'000 CHF

Debt: 450'000 CHF

Nina has no higher expenses planned in the future. She is very new to the investing topic and thus, has no other investments yet.

Nina knows it is time to do something “smart” with her money. Since inflation is eating up her hard-earned money in the bank account she is considering long-term investing. But how? After some research, she stumbled over Selma and wanted to give it a go (especially since the investment plan is for free 😉). In a matter of minutes, Nina finished her chat with Selma and received her investment plan. So what now? Nina is unsure if her current financial state is really good enough to even be able to invest. This is where Selma AI comes into play. With a quick check on the mobile app, Nina can ask exactly all the questions that are stuck in her mind.

Overcome insecurities

Many people are unsure if they even have the means to start investing. With Selma AI this is a question you can get answered within seconds. That is exactly what Nina did. With the “Can you analyze my current financial situation?” question Selma AI will give you an insight into your financial possibilities.

Can you analyse my current financial situation?

- Selma AI question

For example, Nina learned that with the 700 CHF she saves monthly already she is on an excellent way to secure her financial future. Selma AI also told her that her investments (which are currently mostly on real estate) are not as balanced as they should be. Nina mentioned in her investor profile that she has 35’000 CHF set aside for expenses which also includes her cash buffer of 30’000 CHF. Selma AI suggested that the extra 5’000 CHF Nina has set aside could be put to better use. Since Nina is not scared of a little risk and has a long-term investing horizon, she can focus on financial growth. Overall, Nina is on a solid financial trajectory and has the chance to enhance her return with strategic investments.

With the clear insight into her finances, Nina feels more secure and informed. She knows she is already on a good path, but there is room for improvements. And most importantly she is confident she has the financial means to start her investing journey.

Understand your investments

Another aspect of high interest is, of course, your investment portfolio. Selma AI can give you a deeper knowledge of what your investments are meant to do and why they are part of your personalised portfolio.

Can you analyse my investment portfolio for me?

- Selma AI question

Nina was curious as well and wanted to know why her portfolio is looking the way it does. To figure this out she asked Selma AI to “analyse her portfolio.” Selma AI told her that her investment portfolio with Selma is strategically diversified, blending growth-oriented assets with safer investments to balance potential returns and stability. With a focus on growth, a significant portion of her investments is allocated to equities worldwide, including Swiss and international companies, and exposure to emerging markets. Safer investments include global and Swiss bonds, provide stability and regular income, thus mitigate overall the risk of the portfolio. Investments in private equity and precious metals offer opportunities for growth and serve as hedges against inflation and currency devaluation. Nina also got to know that this diversified approach aligns with her risk tolerance and aims for long-term growth and stability.

Start easily

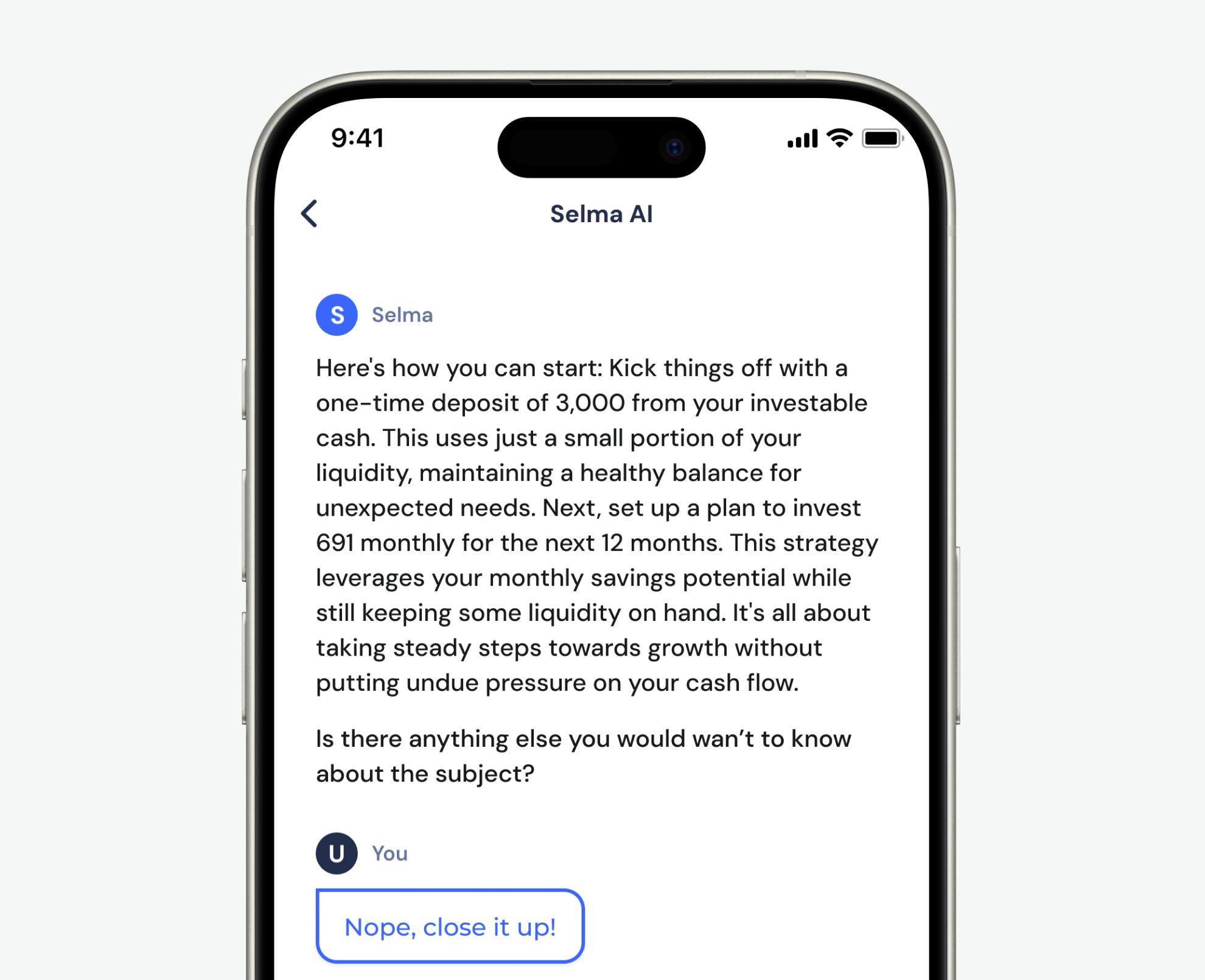

With a good idea on why her portfolio looks the way it looks Nina is confident to take the next step and wants to start investing for good. There is only one question left and it is an important one – how do you actually build your investments over time? This is a good time to ask your 24/7 financial advisor aka Selma AI again.

How should I build up my investments over time?

- Selma AI question

With the question “How should I build up my investments over time?” Nina got a detailed plan on how to tackle her investing journey. Selma AI suggested to start with a one-time deposit of 3’000 CHF from Nina’s investable cash, to still keep some liquidity for emergencies. On a monthly basis Selma AI suggested to invest 691 CHF for a year, leveraging the savings without straining the cash flow. After the first year, Nina could consider investing monthly 525 CHF for ongoing growth.

Thanks to Selma AI Nina has now a better understanding of all things investing and a deeper insight into her financial situation. Of course this is only one example of how Selma AI can support people on their way to financial freedom. In case you got curious now and want to check out Selma AI on your own, head over to the Selma Mobile app and test it yourself.

Sonja Egger

Sonja is a communication pro with background in Media and Intercultural Communication. She is here with the mission to keep your content varied, interesting and enjoyable. Outside of working hours Sonja is either swinging the paint brush or watching cat videos. 😺

Linkedin