Inherited money in Switzerland: A step-by-step guide what to do next

Receiving an inheritance often brings a mix of emotions. While the financial boost can offer new opportunities and security, it's also connected to the memory of a loved one. Balancing these feelings and making informed financial decisions can be a journey in itself.

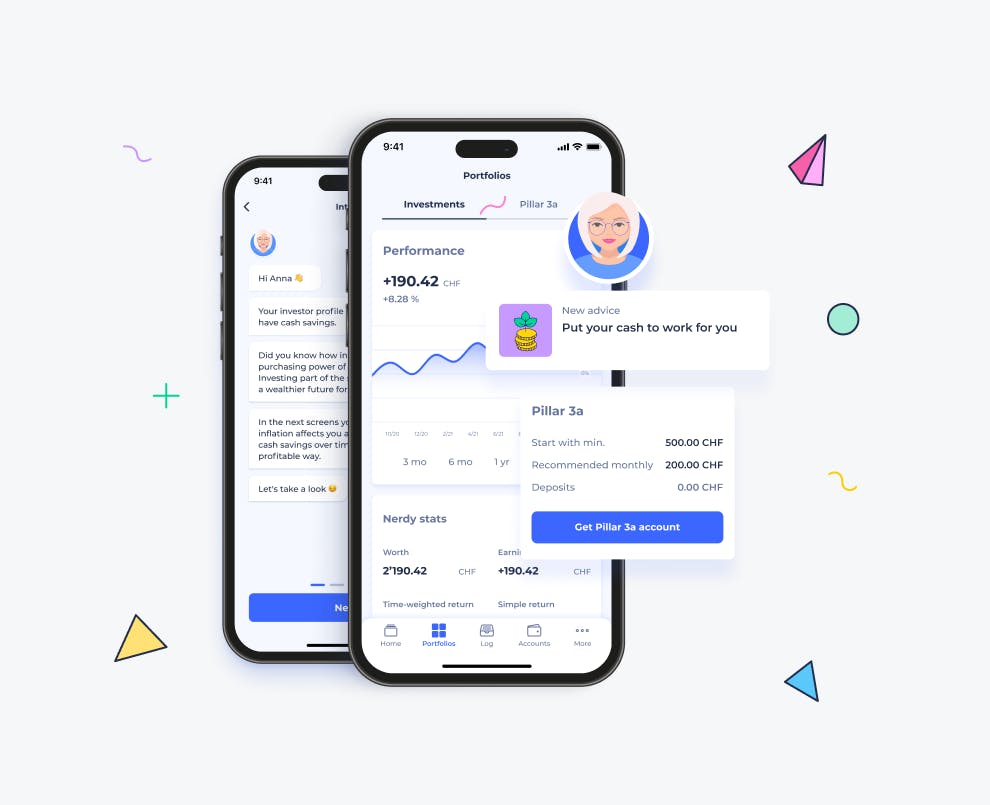

If you're unsure about managing your inherited money, we're here to assist. With Selma Finance, you can craft a personalized financial plan tailored to your inheritance in just 5 minutes. Explore our services for free here.

This guide aims to provide clarity and direction during such important moments.

1. Take a moment and process

Receiving an inheritance is a significant event, often accompanied by a whirlwind of emotions. Remember, there's no rush to make immediate decisions. It's perfectly okay to take your time. It is wise to park the money in a savings account temporarily, allowing yourself the space to grieve, reflect, and eventually plan. When you're ready, both emotionally and mentally, you can then consider the best ways to utilise this newfound wealth.

2. Get a clear picture of your inherited money

Before making any decisions, understand the exact amount and nature of your inheritance. Is it cash, property, stocks or a combination? Gather all necessary documents, such as wills, property deeds, or stock certificates in order to have a comprehensive view. Given the complexities and potential implications of managing inherited assets, it's wise to discuss the nature of the inherited money with a financial expert or advisor. They can provide guidance tailored to your specific situationS and ensure you make informed decisions.

3. Address outstanding debts or taxes

In Switzerland, inheritance taxes are collected on cantonal level, not federal level. This means the specifics of the tax, including rates and exemptions, can vary depending on the canton in which the deceased person was a resident of. Here's what you should consider:

- Cantonal variation: Each of Switzerland's 26 cantons has its own laws concerning inheritance taxes. The rate and exemptions can differ significantly from one canton to another.

- Direct descendants & spouses: Many cantons do not tax direct descendants, such as children inheriting from their parents. In most cantons, spouses are also exempt from inheritance taxes. However, other relatives or non-relatives might be subject to the tax, with rates potentially being higher for more distant relations.

- Gift taxes: Some cantons also collect taxes on gifts made before one's death. The rules and rates for these can differ from inheritance taxes.

- International considerations: If you're dealing with an international inheritance, be aware that Switzerland has double taxation agreements with several countries. However, these primarily concern income and wealth taxes, so consulting with an expert is crucial to understand the specifics.

4. Create or review your financial plan

If you don't already have a financial plan, now's the time to create one. If you have one, consider how this inheritance fits into it. This plan should outline your financial goals, both short-term and long-term, and provide a roadmap for achieving them.

Receiving an inheritance can significantly shift your financial landscape. Here's how it might change your current plan:

- Understanding your current situation: Think about where you and your family stand financially right now. How might this change in the near future, especially with the added inheritance?

- Paying off debts: One of the most prudent uses of an inheritance can be to pay off existing debts. Whether it's credit card debt, loans, or mortgages, reducing or eliminating these liabilities can provide a significant boost to your financial health and peace of mind.

- Planning for big purchases: With the extra money, do you have enough set aside for big plans or purchases in the near future? Maybe that dream vacation or home renovation is now within reach.

- Balancing risks: Your comfort level with taking financial risks might change with more money in hand. It's a good time to see if your investments match your risk comfort zone.

- Integrating the inheritance: Some parts of your inheritance, like stocks or property, might fit perfectly into your current financial picture. Others might be better to sell or convert into something else.

- Checking your asset mix: With this inheritance, you might want to reconsider how much money you've put into things like your home or personal business.

- Thinking ahead of retirement: This extra money could change how and when you plan to retire. It's worth revisiting your retirement goals.

Remember, an inheritance can be a game-changer for your financial plan. It's always a good idea to chat with a financial expert to make sure you're making the most of it.

5. Get a personalised investment plan

Inheriting money will change your financial situation and your investment plan. This is where we would like to support you. Selma Finance is a Swiss digitale wealth manager focused on personalised investment plans. We were established in 2016 and manage long term investments of over 12’000 Swiss investors successfully.

Here's how Selma works:

1. Start with a chat: Engage in a 5-minute chat about your financial situation and investment aspirations. It's free, insightful, and the first step towards your tailored investment plan.

2. Receive your personalised investment plan: Based on your chat, Selma crafts a unique ETF plan that aligns with your risk appetite, financial standing, and future objectives.

3. Personalised consultation: If you're looking for a deeper dive into your financial situation, Selma offers calls with financial experts. They'll help you understand how your new inheritance fits into your broader financial picture and guide you on the best steps forward

4. Open your account online: Set up your investment account online in under 5 minutes. All you need is your laptop or phone and your ID.

5. Sit back and relax: Selma manages, monitors, and adjusts your investments, ensuring they fit with market dynamics and any shifts in your financial circumstances.

Advantages of Selma:

Personalised solution: Selma delves deep to understand your financial scenario, investment ambitions, and values, ensuring your investment plan mirrors your unique profile.

Simplicity at its best: Forget about the paperwork and long waiting hours.s. With Selma, starting your investment journey is straightforward. Automated yet tailored investing: Selma automates your investment activities, ensuring your capital is channelled into the most fitting assets. Yet, automation doesn't mean impersonality. Selma remains vigilant, perpetually monitoring and ensuring your investments stay aligned with your goals.

Fair and transparent pricing: Selma's pricing model is clear-cut. Depending on your investment size, you'll encounter one of three rates: 0.68%, 0.55%, or 0.47%. This is an all-inclusive fee structure made possible through automation, averaging at three times less than traditional Swiss bank investment services.

Low starting amount: Begin your investment journey with just 2’000 CHF, granting you access to a globally diversified portfolio tailored to your life, with the flexibility to invest monthly amounts of your choosing.

Diversified portfolio: Selma champions a globally diversified investment approach. Instead of limiting you to 2-3 ETFs, Selma offers a comprehensive portfolio that spans the entire financial market, ensuring a balanced and diversified investment experience. Read here more about the importance of diversification.

Sustainable investing made easy: With Selma, activating a sustainable strategy is straightforward. You'll still get a globally diversified portfolio, but Selma ensures your portfolio consists of sustainable investment porducts.

Try out Selma for free

Sign up and chat with Selma to get your personalized investment portfolio. You will see exactly in which investment porducts Selma would invest for you and how this portfolio would have performed in the past.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn