Investing and why you should do it

The thought of investing can be frustrating - it is complicated, complex and let’s be honest we all like to postpone this topic to a ‘better suitable time’. BUT your Investment can become your new best friend and you are just about to find out why.

Isn’t investing risky?

When thinking of investing one of the first things that pops into our minds is the loss of money. What if a crisis hits in? What if all my hard earned money disappears because of some poor choices? Fact is, investing long-term is reducing the risk quite a bit.

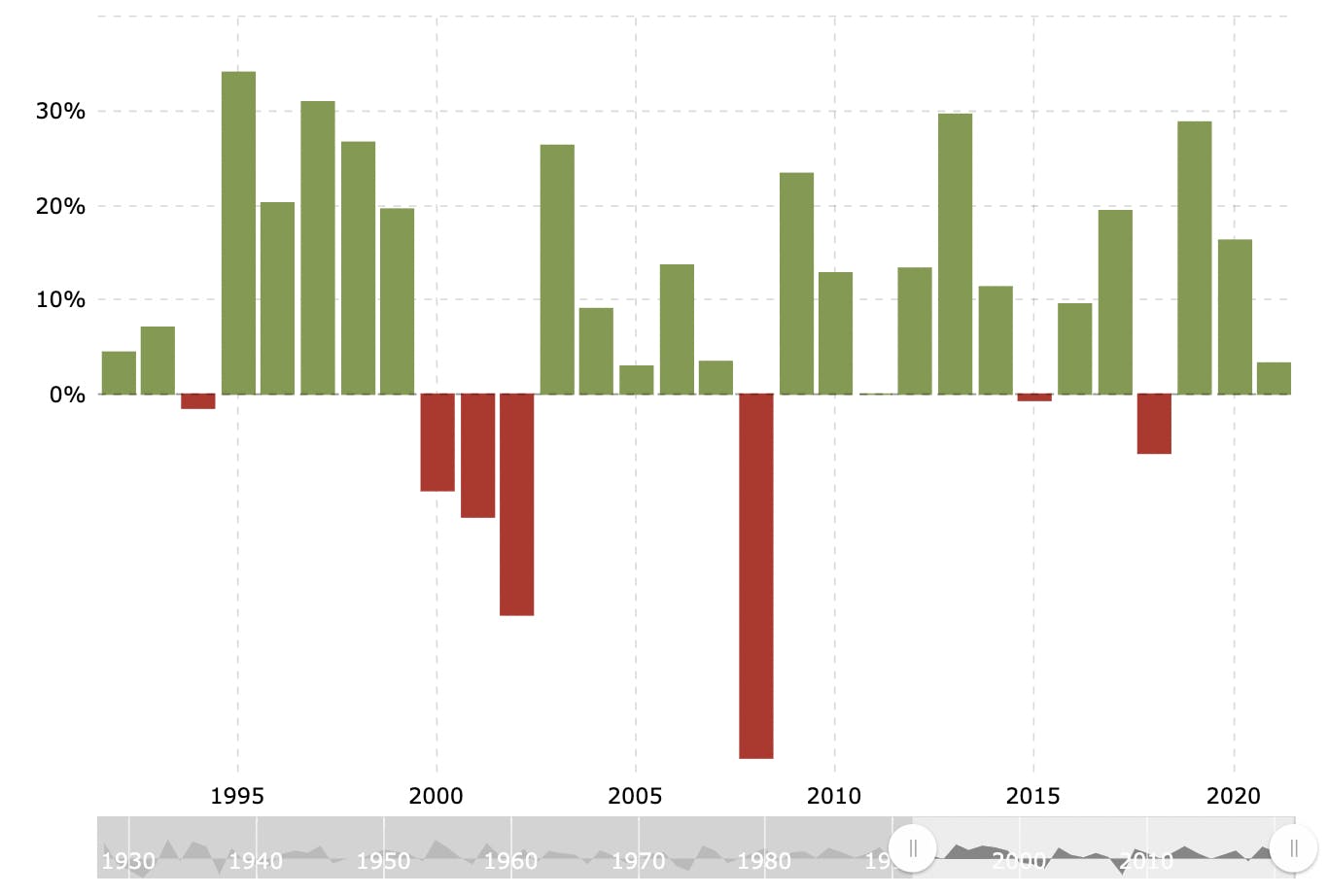

While the stock market does experience a dip from time to time, historically speaking, markets do recover rather quickly and there are more positive years than negative ones. Let’s have a look at the American market. An easy way to do this is to pick an “index” like the S&P 500. This index simply groups and tracks what the 500 largest U.S. companies are doing, which is usually a good indicator for the whole market.

When we peak at the chart we’ll see that in the last 30 years only 7 years had a negative performance, while 23 years performed positive. So, most of the time it is a good idea to sit a negative performances out and wait for better times - because the sun will shine on us again.

Besides helping you to stay on the safer side of investing, long-term investments have also the advantage of the so-called Compound Interest. Compound Interests help you grow your money without doing anything. Yep, you heard right, without doing anything! The main idea here is that when you keep your money on an investment account for a longer period of time (let’s say 10+ years) your returns will accumulate more interest not just only on the initially invested money but also on the accumulated earnings from previous periods. Thus, you have more money to spend later on. 🎉

But I have a savings account…

A savings account keeps your money in cash and there is no risk of losing it. But they also come with high fees and low interest rates. To put it simple, increasing the worth of your savings in a savings account is rather impossible. Especially when you consider inflation. Inflation affects money in every form (on savings accounts, invested or in cash). It worsens your buying power and you can buy a bit less with the same amount of money year by year.

Does it even matter? 🤔

Sure, over a short period of time inflation seems insignificant but think about it - how long do you have your savings account already? Most people do not open an account for just a couple of years but for a longer period of time. During this time inflation already reduced the value of the money on a savings account. Considering the compound growth, long-term saving with an investment account can literally pay-off and lead to a higher increase of money. Who doesn’t want that?

Back to basics: what does it mean to invest in the market?

Simply said, it means - to put your money to work for you. You acquire something you believe will increase in value over time, be it gold/silver, real estates, stocks, mutual funds or ETFs.

Stocks for example are shares in publicly held companies, while mutual funds are a pile of different stocks one can acquire during only one purchase. ETFs allow investors to buy many companies in a single share and they can get traded just like stocks. Stocks, mutual funds and ETFs are handled on the stock market.

Stock what again?

“The stock market” includes different marketplaces all over the world where anyone can buy and sell stocks. Most of the time the term ‘stock market’ refers to the major stock market indexes. Examples are the SMI in Switzerland or the S&P 500 we were talking about already. It is difficult to track every single stock, so these indexes look at a section of the stock market and represent the performance of this section. If you see a headline like “SMI on an all-time high/low” it usually means the index has moved up or down and the stocks within the index have gained or lost value. 📈

TL;DR Why you should invest

So here in short - why should you invest?

- When you invest long-term, you can combat the risk of losing money since the market most of the time recovers quickly after a crisis.

- Compound interests are your friends and play in your pocket if you invest long enough.

- Money on a savings account is losing value over time due to inflation.

- Investing on the market can be done differently but all options have the goal to put your money to work for you. The main goal for all of them is to increase the value of your investment.

Sonja Egger

Sonja is a communication pro with background in Media and Intercultural Communication. She is here with the mission to keep your content varied, interesting and enjoyable. Outside of working hours Sonja is either swinging the paint brush or watching cat videos. 😺

Linkedin