14 tips to start investing in Switzerland

Congratulations on taking the first step on your investment journey. ETFs, shares, funds - Investing in Switzerland can seem like a maze with all its financial terms, especially for first-time investors. With these 14 tips in mind, you can start investing in Switzerland with confidence.

Did you know that only about 10% of Swiss individuals aged 18 to 29 own stocks? According to a study, millennials even prefer going to the dentist over visiting a bank advisor. That's precisely why we've compiled the best tips for investing money in Switzerland for you. With the right approach and strategy, anyone can secure their financial future.

In case you need assistance, we are here to help. With Selma Finance, you can create a tailored investment portfolio in just 5 minutes. Try it out for free here.

Remember, investing isn't a sprint

It's a marathon with its share of ups and downs. Keep these 14 tips in mind, and with perseverance, you'll find the journey to the finish line incredibly rewarding.

Tip 1: Understand your current financial situation

Before you dive into the world of stocks and bonds, take a moment to assess your financial health. How much do you have saved? What are your monthly expenses? Having a clear picture of your finances is like having a map before starting a journey.

Tip 2: Build a cash buffer

Do you have enough reserves for emergencies in your bank account? Before you start investing it is crucial that you have built a so-called cash-buffer. This buffer ensures you don't have to sell investments during unforeseen situations. A good rule of thumb is to keep a cash buffer of 3-6 monthly spendings aside.

Tip 3: Make an investment plan

Now that you have taken a look at your financial situation and built up a cash buffer, it's time to make a clear plan. Your investment plan should consist of two parts: How much money you should invest (one time, and regularly) and in what you want to invest. You will learn more about that in the next tips.

Tip 4: Your first investment = savings - cash buffer - planned spendings

Now that you have built a cash buffer, it's time to think about your fixed spendings in the near future. Do you plan to buy a car next year or is a bigger holiday planned? Do not invest this money. You can calculate your starting investment easily with this rule: Starting investment = Savings - cash buffer - planned spendings.

Tip 5: Step-wise-investing aka Dollar-cost-averaging

If you don’t feel comfortable with investing a big amount of money at one time, you can simply split your investments into multiple steps. This way you can reduce the risk of investing your money at a bad time by building your investments over time. Financial experts call this the dollar-cost-averaging method.

You can read here more about the benefits of investing regularly.

Tip 6: Stick to the 50/30/20 rule

Consistency is key in the investment world. Regular investments, irrespective of market conditions, will help you to build up your wealth over time. But how much should you invest monthly? The 50/30/20 principle is a great way to split your monthly expenses and figuring out how much of your money you should invest on a monthly basis. 50% of your monthly income can be used for your fixed expenses such as rent. 30% for fun, like a good restaurant visit or a new bike. 20% should be used for investing. Of course, the percentages can vary depending on your lifestyle and salary.

Tip 7: Understand your risk level

The core question one should ask themselves when investing is: "How much risk can I take?". Risk is highly individual and depends on factors such as age, financial situation, and personal attitudes. Thus, your personal attitude towards risk is just a small component of the risk you should ultimately take. Every investment comes with its own set of risks. It's crucial to understand the level of risk associated with your investments and be comfortable with it. This ensures peace of mind and confidence in your decisions.

In this blog you can read more about the risk of investing.

Tip 8: Define your investment horizon

The golden rule of investing is: The longer you can invest your money, the better. Don't forget investing is a long-term game – a marathon. Short-term fluctuations in the financial markets are normal. Crises come and go. Historically, despite short-term volatility, markets have yielded positive returns. Therefore, we recommend investing for at least 5-10 years. This way, you can weather the ups and downs of the market, but you also give your money time to work for you.

Tip 9: Don't try to time the market

Is there a perfect day to start investing? If you're looking to invest long-term, the answer is quite simple: Today. Why? Even the most experienced financial experts can't see into the future and predict whether the market will perform well or poorly in the coming months. Historically, investors who have tried to time the market often underperformed compared to those who followed a long-term strategy. Instead of trying to outsmart the market, it's wiser to invest consistently and long-term, benefiting from the market's average returns. Read here, more about this topic.

Tip 10: Diversify

Diversification is the cornerstone of a balanced investment strategy. By spreading your investments across various assets, you mitigate risks and harness the strengths of different sectors. A great way to do so is with ETFs (Exchange Traded Funds). ETFs hold multiple assets such as stocks, bonds, or commodities. They aim to track the performance of a specific index, offering a way for investors to get the returns of a broad market or sector without having to buy each individual security.

More about the benefits of diversification you can read in this blog article.

Tip 11: Smile when the market goes down

The financial market has its ups and downs. Crises are part of your investment journey, so always keep one thing in mind: Stick to your initial plan. Frequent changes to your strategy can be counterproductive. Stay on the course and trust your initial research. Don’t stop investing simply because the market is going down. This is, in fact, the best time to build up your investments. By sticking to your plan in bad market periods, you have the chance to buy investments for a good price.

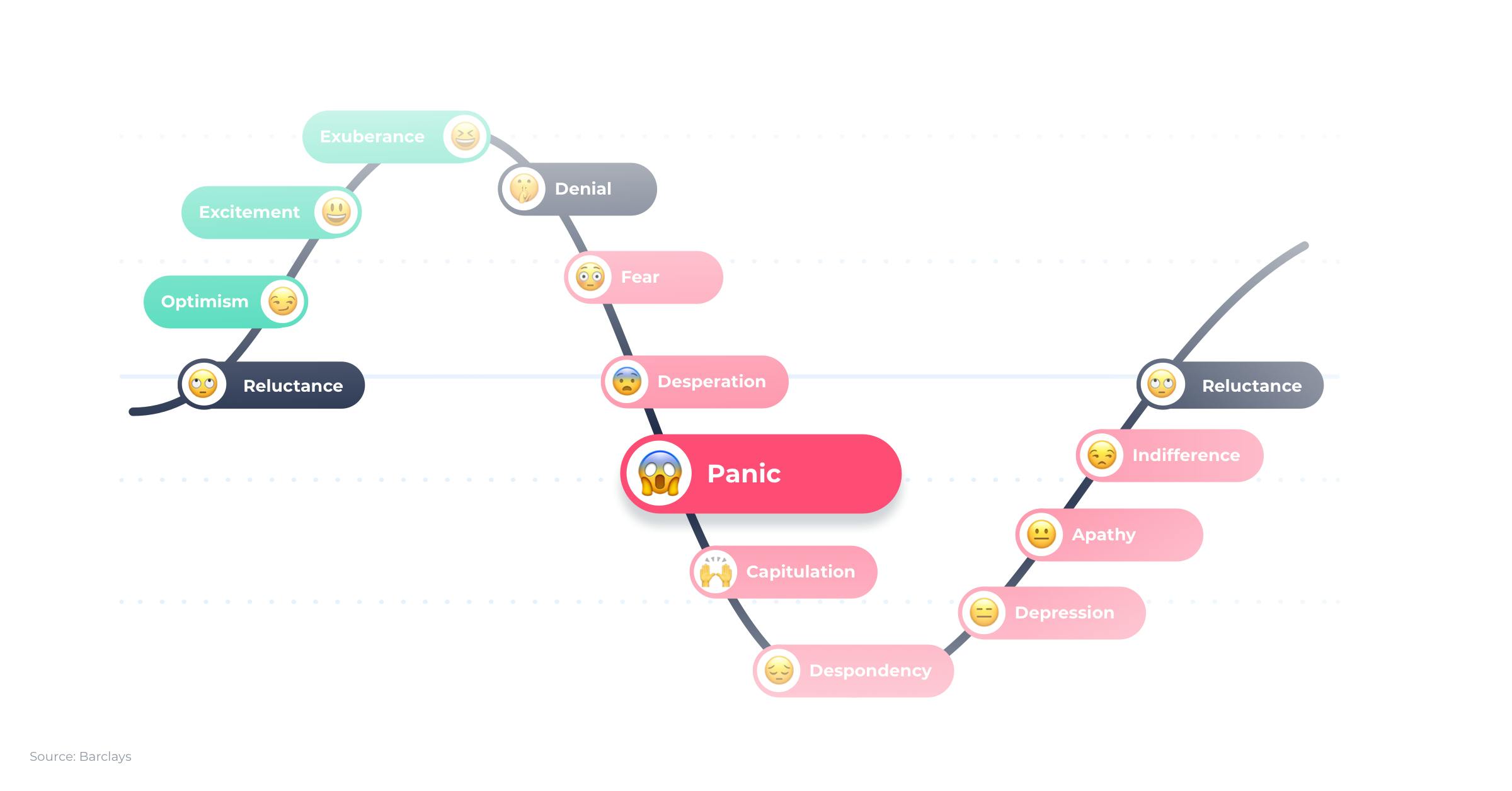

Tip 12: Don't listen to your emotions

Euphoria, fear, panic, and greed. Emotions are the biggest adversaries of every investor. The magic rule for a good investor is simply, never listen to your emotions. Stick to your initial plan and let time grow your investments. Don’t sell your investments with fear and panic in the market, but also don’t let your emotions guide you to invest more or in specific assets.

Tip 13: Listen to Einstein

Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn't… pays it.” Compound interest is the principle where your interest earns interest. Over time, this can lead to exponential growth of your investments, especially if you start early. Thus, you should always be patient and let compound interest do its work.

Tip 14: Avoid FOMO

Trends come and go. Just because a particular investment is the talk of the town doesn't mean it aligns with your financial goals. Make decisions based on research, not hype. Never forget more people burned their fingers by following hypes than people got rich out of it.

In conclusion

ith these 14 tips in mind, you can start your long-term investing journey without stumbling after the first few steps. Equip yourself with knowledge, plan meticulously, and embark on your investment journey with confidence. Happy investing in Switzerland! 🇨🇭💰🏔️

Start your investing journey today with Selma

Do you want to start investing but seek expert guidance to create and automatically manage a portfolio for you? Then Selma is just right for you.

With Selma, you receive a tailor-made ETF investment plan that automatically adjusts to changes in your financial life and the financial market. Founded in 2016, Selma proudly manages the investments of over 12,000 Swiss investors today.

Here's How Selma Works:

1. Start with a chat: Simply sign up for free and engage in a 5-minute chat about your financial situation, investment aspirations, and values.

2. Get your personalised ETF Plan: Drawing insights from your chat, Selma designs a unique ETF plan tailored to your risk appetite, financial standing, and future objectives.

3. Open your account online: With just your laptop or phone and your ID, you can seamlessly set up your investment account online in under 5 minutes.

4. Sit back and relax: No need to be glued to market tickers. Selma takes charge, managing, monitoring, and adjusting your investments in response to market dynamics and any shifts in your financial circumstances.

The advantages of Selma:

Personalised solution: At Selma, we understand that every investor is unique. That's precisely why, with Selma, you receive a personalised investment plan tailored to you and your goals.

Simplicity at its best: Forget the complicated paperwork and long wait times. With Selma, starting your investment journey is a breeze. Open your account online in just 5 minutes and keep an eye on your investments via the app.

Automated yet tailored investing: After your individual ETF investment plan has been created, Selma takes the helm. Your investments are purchased for you and automatically adjusted to market changes.

Fair and transparent pricing: Selma's pricing model is based on your investment volume. Your investments are managed for a transparent monthly fee. Depending on your investment size, you'll encounter one of three rates: 0.68%, 0.55%, or 0.47%. This all-inclusive fee structure is made possible through automation, averaging at three times less than traditional Swiss bank investment services.

Low starting amount: You can start with just 2000 CHF. This amount is necessary in order to build a globally diversified portfolio for you.

Diversified portfolio: Selma adopts a globally diversified investment approach. Instead of limiting yourself to 2-3 ETFs, Selma offers a globally diversified portfolio that covers the entire financial market.

Sustainable investing made easy: With Selma you have an option to activate a sustainable strategy. You will still get a global diversified portfolio, however Selma makes sure your portfolio consists of ESG or SRI ETFs.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn