AI, algorithm, and investments: The future of investing in Switzerland

Remember the days when investing meant donning your best suit, walking into a grand banking hall, and having a chat over a cup of coffee with Mr. Müller, your bank advisor? You might not – but your parents will definitely.

Fast forward to today, and while MR. Müller might still be somewhere around in the bank, but many of us haven't stepped into a bank in years. Instead, we're navigating the world of investments from the comfort of our homes, guided by algorithms and digital platforms.

Let’s explore the evolution of traditional Swiss banking and have a look at what the next wave of financial innovation could be.

The past: The era of personal bank advisors

In the not so distant past, stepping into a bank meant meeting a guy in a suit who purely radiated financial wisdom. He was a personal financial advisor. Most likely he brought you a cup of coffee, led you to a polished desk and you started talking finances.

This traditional model had its charm. It was personal, built on trust, and offered a sense of security. But it wasn't without its flaws. While the personal touch was appreciated, it came with a price tag, thus not accessible to everyone. The world was evolving, and with the rise of technology, the financial sector was ripe for a revolution.

The 2000s: The dawn of digital investing

As the new millennium rolled in, the internet began to reshape countless industries, and the financial sector was no exception. The once exclusive world of investing started to democratise. No longer did one need to walk into a bank or call up a broker to buy stocks. With just a few clicks, anyone could dive into the stock market from the comfort of their home.

This era heralded a significant shift. Investing was no longer just for the elite or those with deep pockets. The barriers to entry were lowered, and a broader audience could now participate. However, this newfound accessibility came with its own set of challenges. The platforms were often cluttered with financial jargon and complex interfaces. They catered to those who had a foundational understanding of the financial markets. For the everyday person, it was like gettinga sports car without knowing how to drive.

Despite the digital advancements, the essence of personal advice remained largely unchanged. The majority still relied on their personal financial advisors, now through emails or phone calls instead of face-to-face meetings. The digital tools were there, but they were yet to be fully harnessed to revolutionise personal financial advice.

The present: Rise of algorithms and robo-advisors

Fast forward to today. The landscape of personal financial advice has undergone a radical transformation. Enter the era of DIY–Platforms and robo-advisors, where algorithms and technology have taken centre stage. These digital platforms have democratised financial advice, making it accessible to everyone, regardless of their wealth or financial knowledge.

Robo-advisors harness the power of algorithms to provide tailored investment advice. After gathering information about an individual's financial situation, goals, and risk tolerance, these algorithms craft a personalised investment strategy. This ensures that each investor gets a plan that's uniquely suited to their needs, much like the bespoke advice once offered by human advisors.

Moreover, by automating many of the processes that were once manual, these platforms have significantly reduced operational costs. This means investors not only get personalised advice but also benefit from lower fees and charges. In essence, algorithms have levelled the playing field, ensuring that high-quality financial advice isn't just a privilege of the few but a right for all.

In essence, the modern age of investing has combined the best of both worlds: the personal touch of tailored advice with the precision and efficiency of technology. The result? A more inclusive, accurate, and efficient investment landscape.

The future: What role will AI play in tomorrow's financial landscape?

Just a few years ago, the idea of AI playing an important role in our daily lives seemed like a distant dream. Yet, the future has a way of arriving unannounced. Today, while ChatGPT dazzles us with its linguistic prowess, it's not quite ready to be our financial guru. As advanced as it is, it's not equipped to offer stock tips or predict market fluctuations. But this leads us to ponder: As AI continues its rapid evolution, how will it redefine the landscape of investing?

We posed this question to ChatGPT. Here’s how it envisions the future of AI in the financial world:

AI-powered financial guidance

In the not so distant future, advancements in AI could mean that everyone essentially has a financial advisor right in their pocket. Imagine a world where all your financial data – from your income, debts, and investments to your aspirations and dreams – is interconnected. This AI wouldn't just offer generic advice; it would deeply understand your financial goals, risk tolerance, spending habits, and even the financial topics you search or read about online. With this comprehensive perspective, it would provide real-time, hyper-personalised investment tips tailored precisely to your current interests and life stage, making informed decisions more accessible than ever.

Real-life adjustments to your portfolio

Imagine making a significant life decision, like buying a house or having a child, and your AI-powered app adjusts your investment strategy in real-time to reflect these changes. As the integration and development of AI in such platforms progress, the precision and responsiveness of these adjustments will only improve. It's a vision of a future where technology and intelligence seamlessly collaborate to tailor investment decisions optimally to life circumstances.

Cost efficiency:

One of the most significant advantages of AI-driven financial advice is the potential for cost savings. By automating many of the tasks traditionally handled by human advisors, AI can offer personalised financial advice at a fraction of the cost. These savings can then be passed on to consumers, democratising access to financial advice.

Ethical and socially responsible investing

As we all become more conscious of the ethical implications of our investments, AI can play an important role in promoting socially responsible investing. AI can analyse companies' practices, sustainability efforts, and other relevant factors to determine if they align with an investor's ethical criteria. This makes it easier for investors to ensure their portfolios reflect their values, without having to look through vast amounts of data themselves. In essence, AI can act as a moral compass, guiding investors towards choices that resonate with their beliefs.

Summary

If we've learned anything from our dive into the past, present, and future of investing, it's that predicting the future is a tricky business. Who could have foreseen in the 90s that you will manage your investments mostly via apps and online platforms? Who would have guessed that you will get a personalised investment portfolio that is fully automated managed for you without ever leaving the comfort of your couch?

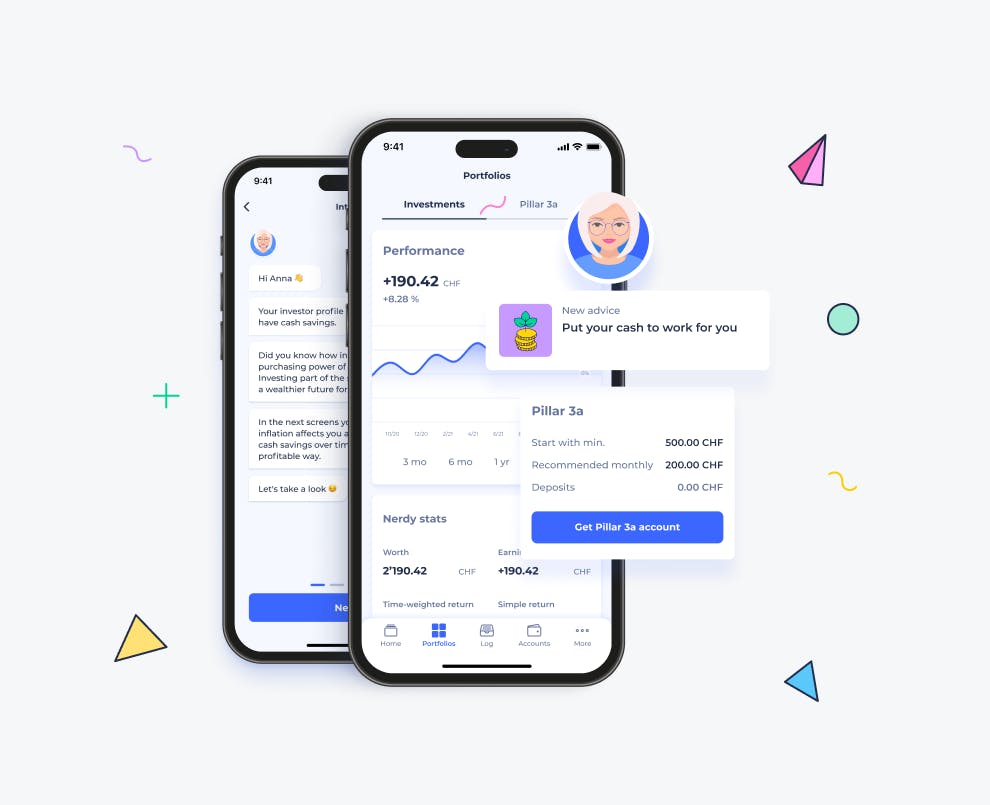

While we might not be on the brink of unveiling the ultimate real-time AI stock-picker that makes everyone rich, part of AI's vision is already becoming a reality. Robo advisors like Selma Finance, are already creating personalised portfolios that automatically adjust to one's financial situation. You can obtain a portfolio tailored to your values, and it's already more cost-effective than traditional banking solutions.

As we look forward to more tech advancements, let's keep in mind that the future has unexpected twists we might not see coming. However, AI will further refine and enhance these processes. But one thing's for sure: it's going to be an exciting ride. So, buckle up, keep an open mind, and let's eagerly await the next chapter in the ever-evolving world of investing.

Try out the future of investing today

No, Selma Finance does not use AI to improve your investment performance. However, you will get a personalised investment portfolio that will be automatically managed for you.

With Selma, you receive a tailor-made ETF investment plan that automatically adjusts to changes in your financial life and the financial market. Founded in 2016, Selma proudly manages the investments of over 12,000 Swiss investors today.

Here's How Selma Works:

1. Start with a chat: Simply sign up for free and engage in a 5-minute chat about your financial situation, investment aspirations, and values.

2. Get your personalized ETF Plan: Drawing insights from your chat, Selma designs a unique ETF plan tailored to your risk appetite, financial standing, and future objectives.

3. Open your account online: With just your laptop or phone and your ID, you can seamlessly set up your investment account online in under 5 minutes.

4. Sit back and relax: No need to be glued to market tickers. Selma takes charge, managing, monitoring, and adjusting your investments in response to market dynamics and any shifts in your financial circumstances.

The advantages of Selma:

Personalised solution: At Selma, we understand that every investor is unique. That's precisely why, with Selma, you receive a personalised investment plan tailored to you and your goals.

Simplicity at its best: Forget the complicated paperwork and long wait times. With Selma, starting your investment journey is a breeze. Open your account online in just 5 minutes and keep an eye on your investments via the app.

Automated yet tailored investing: After your individual ETF investment plan has been created, Selma takes the helm. Your investments are purchased for you and automatically adjusted to market changes.

Fair and transparent pricing: Selma's pricing model is based on your investment volume. Your investments are managed for a transparent monthly fee. Depending on your investment size, you'll encounter one of three rates: 0.68%, 0.55%, or 0.47%. This all-inclusive fee structure is made possible through automation, averaging at three times less than traditional Swiss bank investment services.

Low starting amount: You can start with just 2000 CHF. This amount is necessary in order to build a globally diversified portfolio for you.

Diversified portfolio: Selma adopts a globally diversified investment approach. Instead of limiting yourself to 2-3 ETFs, Selma offers a globally diversified portfolio that covers the entire financial market.

Sustainable investing made easy: With Selma you have an option to activate a sustainable strategy. You will still get a global diversified portfolio, however Selma makes sure your portfolio consists of ESG or SRI ETFs.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn