Market update: Are we there yet?

Selma – your friendly and hardworking bot has again crunched some numbers to show you the powers of steady investing

In a nutshell:

- Markets for company shares have not fully recovered yet, but the recent uptrend has been fast. Major economies are chugging along, better than consensus forecasts expected.

- Like in traveling, getting to your destination can feel slow and tiring in investing as well. We show that it’s totally normal for investments to chase their previous highs in 7 out of 10 years. Keeping a steady course is the key to successful investing.

- Selma has identified some changes in market valuations. It will buy a bit more of US and Swiss company shares, and reduce the portfolio shares going into Emerging Markets company shares and into Private Equity. If you have the sustainability investments option turned on, the changes in the Private Equity investments don’t affect your portfolio.

Starting a recovery

Here is a quick recap of financial markets for those of you, who are also busy with storing away your ski equipment at the end of winter, or who are, like me, constantly checking if ice hockey playoff season tickets are finally available.

(Disclaimer: This text has been written by a human being, not by chatGPT or any other chatbot) 😉

It’s been a year since the start of the Russian invasion of Ukraine. Major indices for company shares have not fully recovered yet from a tough year 2022. But the last few months have seen a very fast uptrend. Indices have started to recover from their lows since October, especially in Europe, but also in Switzerland and in the Emerging Markets. The major US index (S&P500) has recovered a bit lazier.

At the last update in December, Selma’s valuation-based adjustments stuck to a slightly smaller-than-usual weight in US company shares. This seems to have been a wise choice given the aforementioned market trends.

So far, no recession

Many experts have been and still are warning of recession risks. So far Switzerland and the key industrialised economies of the world are still chugging along. Recently, European economic sentiment has beaten consensus expectations. Not that it matters much for long-term investors who can usually afford to look through recessions, anyway.

Are we there yet?

Like most journeys, successful investing can feel terribly slow and never ending. Similarly, you may feel some impatience about markets still trading below their 2021 record-highs despite the recent rally. Those who have loans in their portfolio have seen even less gains so far, as the loan investments are temporarily hurt by the rising interest rates (read here more about the impact of higher interest rates on loans (a.k.a. bonds).

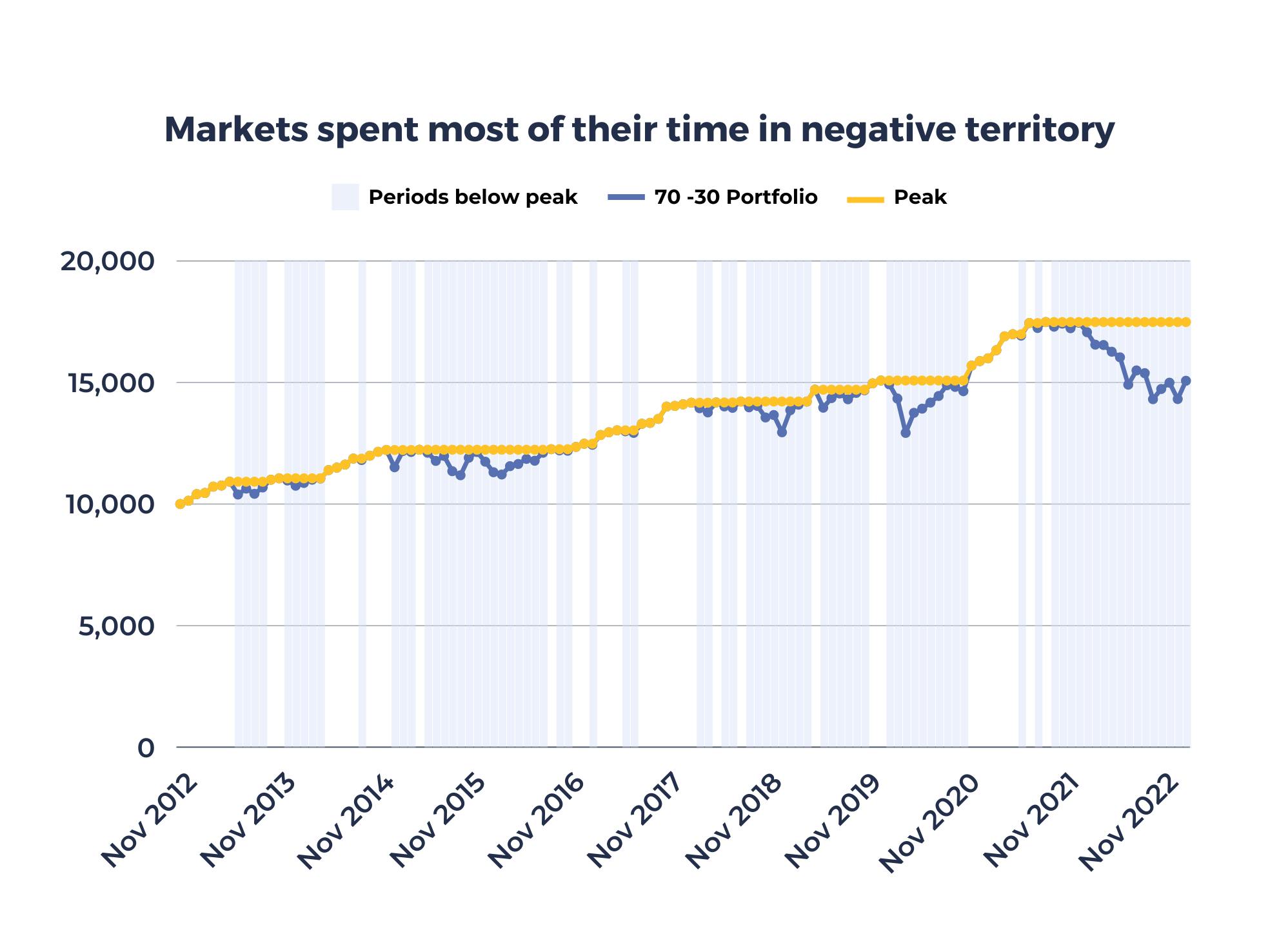

It is actually very normal for financial markets to chase their last peak level. As you can see in the chart below, most of the time markets are below their most recent highs. Our example portfolio, consisting of 70% investments in company shares and 30% in loans to countries, was chasing its previous highs for almost 7 out of the last 10 years.

Disclaimer: Past performance is no indication of future performance!

However, like in a good journey, patience will usually be rewarded. There were only four major uptrends in those 10 years, but they took the example portfolio to ever new record highs. Some of the uptrends lasted well shorter than one year, but this was enough to almost double the original investment amount over these 10 years.

Market downturns, or sluggish “sideways” periods, tend to last much longer than uptrends, which usually are quite short but strong. 🏋️♀️

Hence, time in the market beats timing the market! The longer you stay invested with a strategy that suits you, the better are your chances to eventually benefit from rising markets.

Selma’s adjustments

As mentioned above, US company shares have recently had a somewhat shallower uptrend than European shares. In light of this, Selma identifies some shift in valuations: US shares (and Swiss shares also) have become a bit more attractive compared to Emerging Markets and Private Equity. You can read here more about how Selma uses valuations to optimize portfolios.

As a result, Selma will invest a bit more in US and Swiss company shares. Accordingly, your portfolio shares which are invested in Emerging Markets and Private Equity will become a bit smaller.

If you have turned on the sustainability investment option, your portfolio doesn’t have Private Equity. Hence, mainly your portfolio share, which is invested in Emerging Markets will be reduced a bit. This amount will go predominantly into Swiss companies. (You can read more about how Selma puts your investments together).

Daniel Trum

Daniel is an economist (MSc) and financial analyst with over 10 years experience in the Swiss banking industry. He leads the investment management at Selma and he’s passionate about finding better ways to invest for everybody. Follow him on LinkedIn to get regular updates on what he thinks about financial markets.

LinkedIn