Markets are on the rise – what now?

What’s the right way to handle your wealth and investments when markets are recovering or doing well?

Let’s look at world markets with a bird’s eye view and dive into learnings from the past years before getting detailed tips on how to invest right now.

- Update on financial markets after a long tumultuous period

- Insight into what paid off for investors during the last years

- How Selma can help you invest the right way

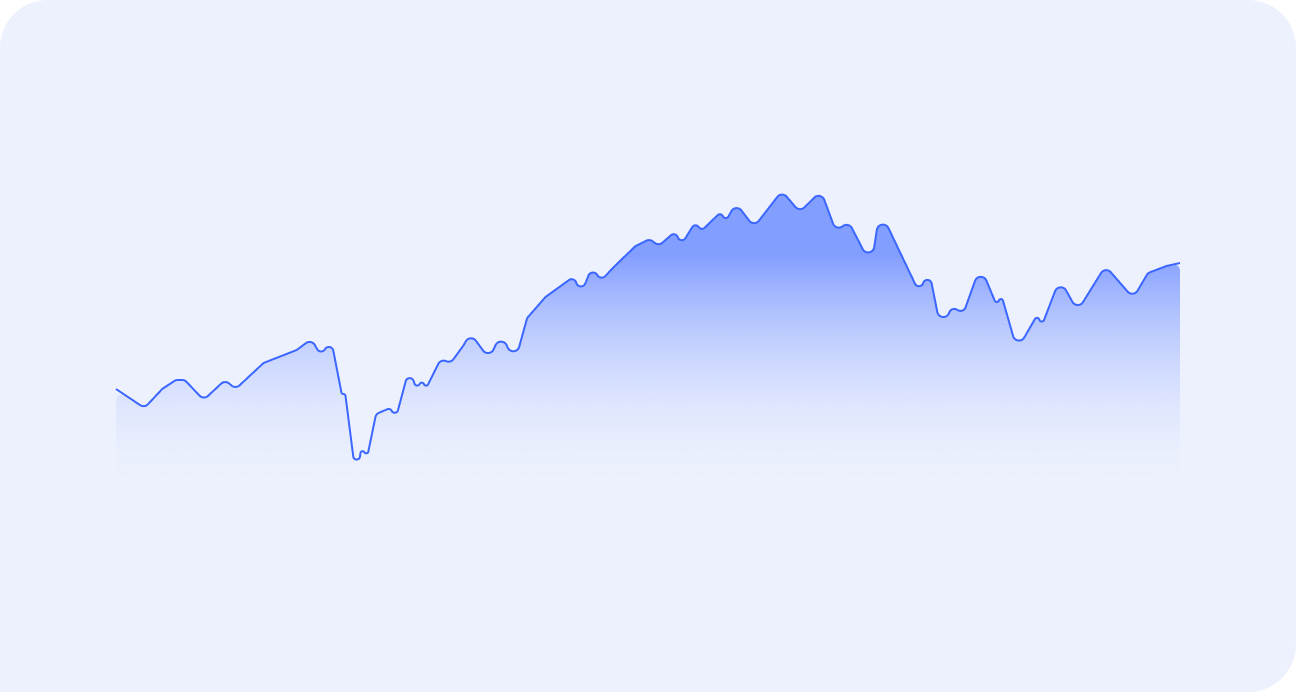

Tough times and the rise: 2021 until now on the world’s financial markets

Can you guess the main takeaway of this graph? Markets are resilient.

You can see dips connected to geographical, political, or financial crises throughout our recent history, but you can also see how markets can recover – quickly.

Even now, in times of extreme turmoil around the world that has left people and investors uncertain about the future, markets are gradually recovering. And together with markets, your investments’ growth is picking up.

Navigating emotional investing

There's an old saying: "Emotions are the worst investors."

It warns us not to panic when the market dips or get too excited when it rises. We often think we won't fall for these traps, telling ourselves we're different.

In reality, it is very difficult to start investing money during times of turmoil or staying invested when prices drop.

Let’s put it into the context of the past years: Meet Joel.

Joel started investing right after the Covid-19 crisis hit. Financial markets had crashed, but quickly recovered, leading to a boom and investing trend in Switzerland and all over the world.

It all sounded and looked very positive, so he joined a wave of new investors.

But then, Joel’s investment journey turned into quite an emotional rollercoaster. After all, he had started at the peak of the corona boom. 2021 came around and the markets started struggling – for a long time.

Initially, Joel stuck to a plan, investing a fixed amount every month. However, as the market continued to drop, he watched his investments performance drop as well.

Overwhelmed and unsure of what to do, he stopped his monthly investments and, after two years of persistence and lots of worrying, withdrew his remaining investments.

Joel’s story is very common. We care about our money and want to see it grow.

So, what happened here?

If you invest when markets are doing well, but stop when markets take a dip, you might see your investment performing badly for a long time, as you need to wait until markets recover to the point when you purchased your investments! 📈

If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.“

- Warren Buffet

Markets have struggled since 2021, taking a long time to fully recover which is why a one-time purchase of investments in wonderful conditions (which comes with high prices) can end up being a stress factor if followed by a long time of uncertainty and provokes many investors to withdraw money.

Unfortunately, this is the most harmful action you can take regarding your wealth.

What worked well for investors since 2021? Consistency.

The key to making it through recent market conditions was regular investing.

Regular investing has helped all investors who have been investing since before or starting 2021. It’s a great way to build wealth because you are committed to keep investing also when prices are low – when markets are tough.

This allows your money to grow once markets recover!

Everyone who invested when prices were low is benefitting now.

I have stopped investing after 2021, what do I do?

You

- have a look at your financial big picture

- see what plan you want to stick to

- and make sure you can keep the money you’ve invested as investments so you don’t lock in those losses by withdrawing money when it’s worth less than before!

And then, you start with your own regular deposits which will help you get through great AND turbulent times.

Professionals also call this “Dollar-cost-averaging” which on average allows you to automatically buy more when it’s cheap, and less when it’s expensive.

Dollar-cost-averaging a.k.a. regular investing allows you to stay consistent, stick to your plan, and start now.

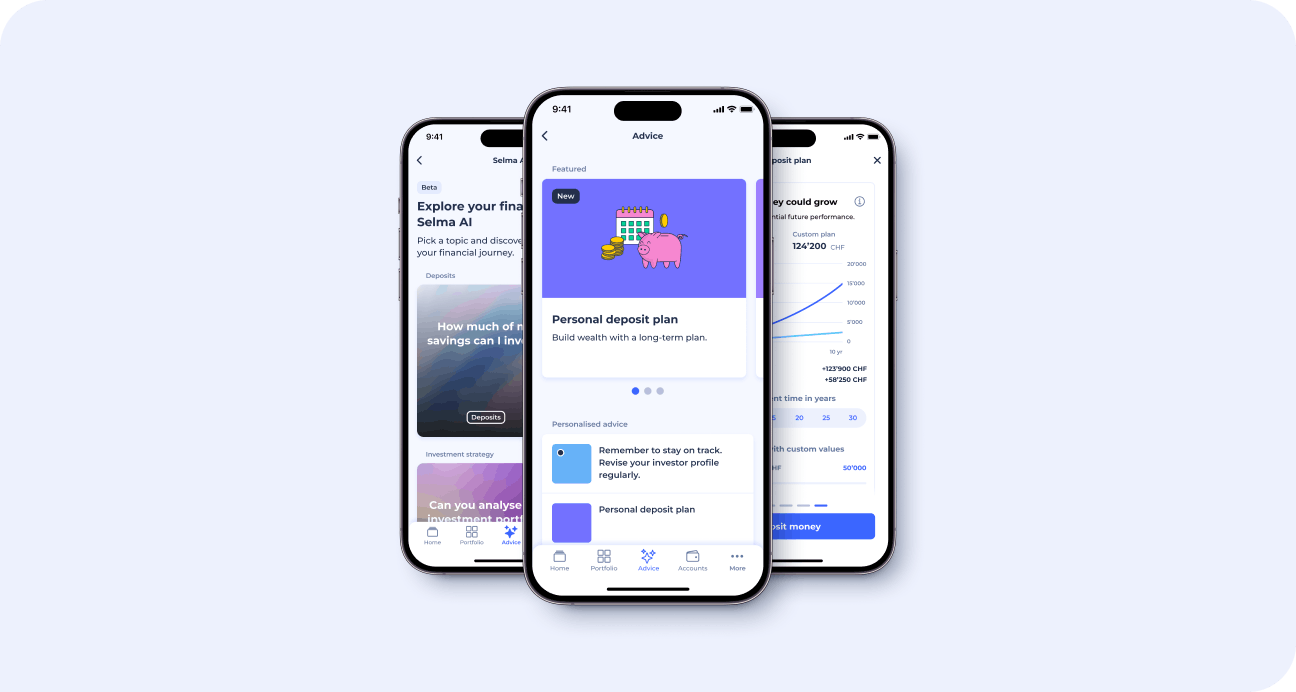

Get personalised recommendations from Selma

Selma tells you how much to invest now, over the next 12 months, and regularly based on your personal financial situation.

If you haven't already, download the mobile app for iOS or Android and

- Explore your Personal deposit plan and your wealth’s growth projections

- Chat with Selma AI, Selma’s new AI-powered chat solution. You can ask her questions about your finances, just like you would with a financial advisor.

Recap: What should you do now to benefit from this phase in markets?

- Set up a regular investing plan

- Stick to your plan

Boring yes, but effective. 🤓 Simplicity and consistency are usually your allies when growing your wealth over the long term.

Remember the most important principles of investing

Being smart about investing means following an approach that is:

- Tailored – invest in a way that fits your individual life and the risk levels you should take

- Long-term – invest for the long term, and keep your money invested

- Diversified – make sure you invest in many different investments at once, globally but also across asset classes

- Regular – invest regularly, it helps you to stick to your plan, builds wealth over time, and also allows you to benefit from investing during difficult times on the market

Carina Wetzlhütter

Carina makes technology understandable. She joined Selma to help explain finance in a more human way. Winter being her favorite season, she loves ❄️ and 🎿.

LinkedIn