Lessons from a difficult year

Selma – your friendly bot who follows financial markets 24/7 – looks back at the year 2022 and draws some interesting conclusions.

In a nutshell:

- The year 2022 was tough for investors, especially the first 9 months. But markets launched a recovery in the last quarter, highlighting how quickly trends can change.

- Monthly investing with a strategy tailored to your needs is the best way to approach the new year. Trying to forecast economic and financial developments, however, would be futile and would probably not even make a difference to your investments.

- The latest market shifts just require minor adjustments in your portfolio. If there is a real estate fund, Selma will buy a bit more, using some money from your investments in Emerging Markets company shares. If you don’t have real estate in your portfolio, Selma will buy a bit more US and Japanese company shares.

A promising end to a difficult year

Are you currently waiting for your mulled wine and need a good read to pass time? Here’s your short recap of the financial year in Selma style.

Financial markets were under constant pressure in 2022: War in Europe, lockdowns in China, crashes in crypto currencies and several tech company shares plus the highest inflation in Europe and the US in over 40 years. For the first time in around 40 years, a broadly based portfolio with company shares and bonds got hit on all sides at the same time.

However, the last quarter of 2022 has shown how quickly trends can change. For example, within a few weeks the German index for company shares DAX40 made up more than half of the losses it incurred over the 9 months before. Inflation and long-term interest rates have also started to retreat from their year-highs. Hence, a broadly based portfolio made gains on all fronts. 💪

Anyways, Selma would say that the beauty of long-term investing is it doesn’t require forecasting short-term trends.

Don’t try forecasting 2023

Forecasting economic and general financial market developments is a difficult task and chances for success are extremely limited. It is not surprising only some (very exclusive) hedge funds are trying to consistently employ such forecasts for investing. Historically, they rank low among the various other hedge fund strategies. 🧐

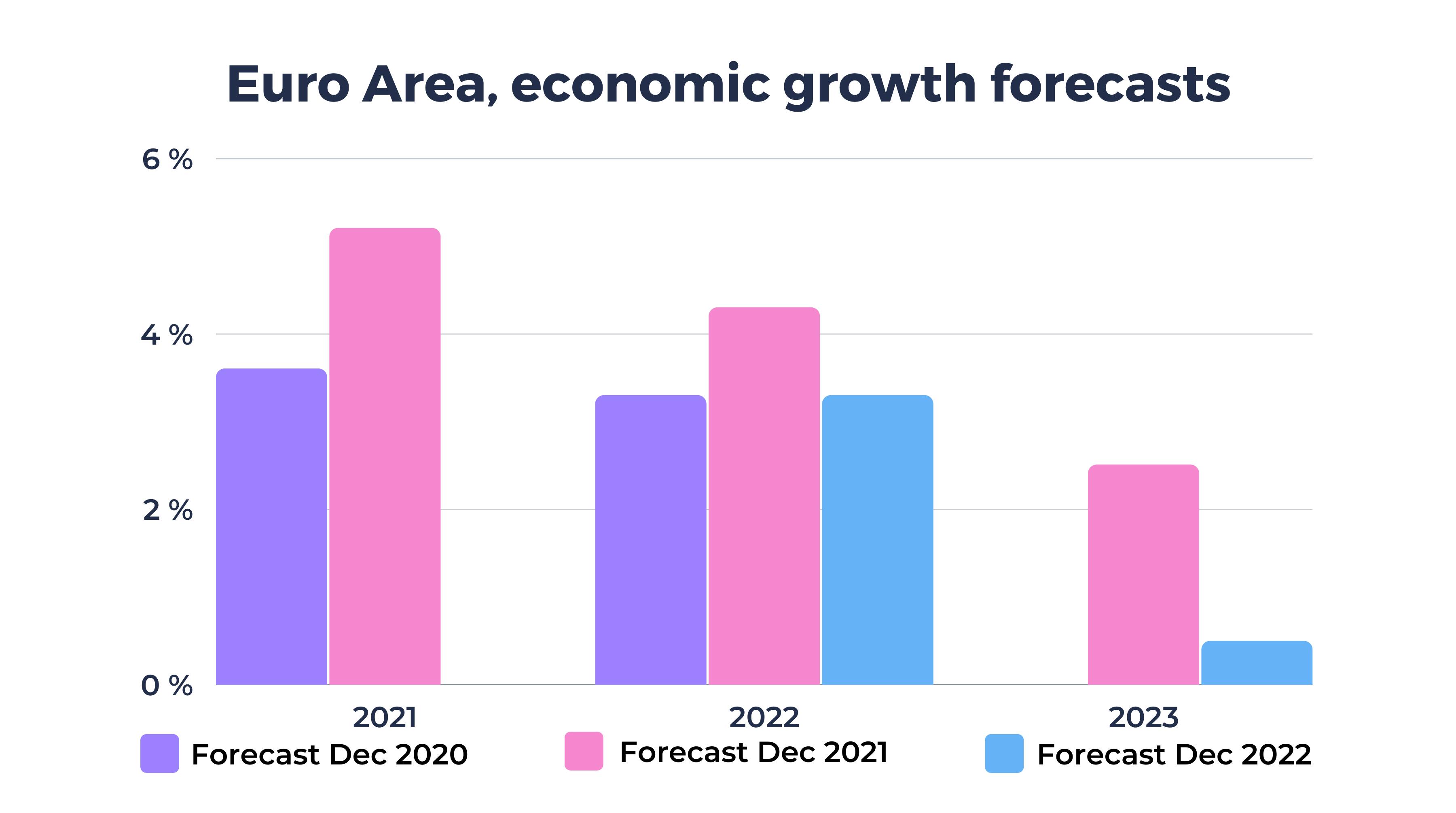

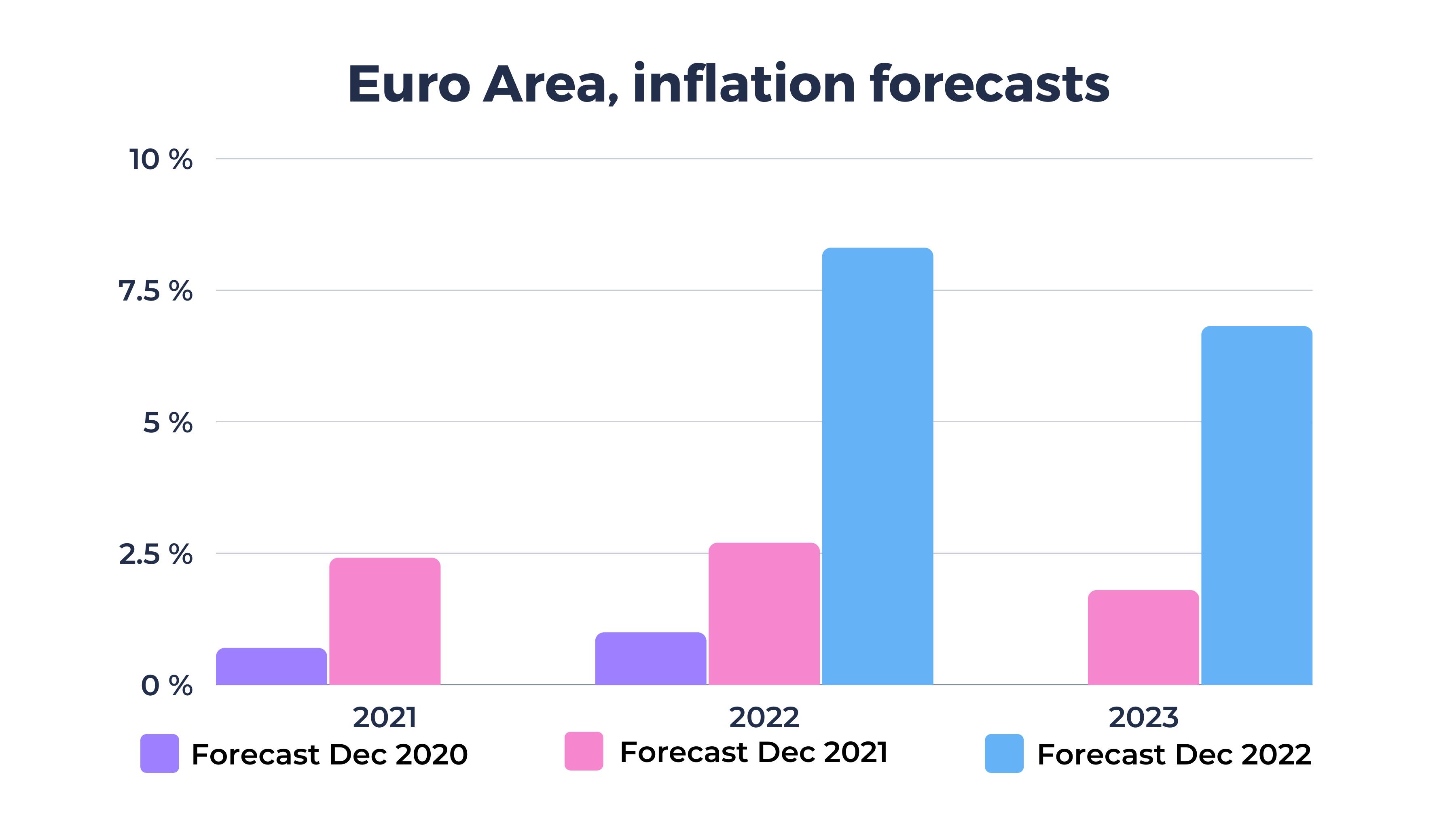

Just to give one example of the difficulty (and usefulness) of forecasts: Consider the OECD’s (Organisation for Economic Co-operation and Development) attempts to forecast economic growth and inflation for the Euro Area.

As you can see, the initial forecasts were often wildly off the mark, and had to be revised quite a lot, especially for inflation.

The magic crystal ball wouldn’t work

Would precise forecasts actually have made any difference to the investment strategy? Selma thinks it’s very unlikely.

Even if one anticipated a growth slowdown and rising inflation, it wouldn’t have been clear how one should adjust the investment strategy. The forecasts above still don’t show a clear recession. Without a recession, slower growth and higher inflation would probably call for shifting investments away from loans to company shares. With a recession, the opposite would apply.

Eventually, we all found out in 2022 that the traditional shifting between company shares and bonds didn’t help: both suffered losses.

How to invest with delight

This may all sound very disheartening to you, but Selma thinks it’s by far not a reason to give up! Here are some simple tips for investing with a feeling of delight without the worries of forecasting:

- Position for long-term growth of your investments:

The best trading days (and months) often happen right after the worst. Hence, time in the market beats timing the market! - Monthly investing means spreading your investments across time:

That way you get more stable entry prices and you can put fresh cash to work faster, thus boosting your returns over the long term. Furthermore, you make it easier for Selma to keep your portfolio in balance, effectively reducing trading costs a bit. 💰 - Spreading your investments (aka diversification) still gives you the best chances to have better performing assets in your portfolio, which can offset the worse performing ones.

Selma buys a bit more real estate

Recently, there have been small differences in the developments of the growth investments Selma uses in your portfolio. Hence, the Selma bot sees no reason to apply major changes at this time. The only significant change this quarter is that a slightly larger portion of your portfolio will be allocated to real estate (if you have real estate in your portfolio – see how Selma puts your investments together).

In exchange, there will be a slight reduction of Emerging Markets company shares. Recently, their valuations have become a bit less favorable.

Daniel Trum

Daniel is an economist (MSc) and financial analyst with over 10 years experience in the Swiss banking industry. He leads the investment management at Selma and he’s passionate about finding better ways to invest for everybody. Follow him on LinkedIn to get regular updates on what he thinks about financial markets.

LinkedIn