Market update: Buy in May… and in every other month

Selma – your friendly bot who never gets tired shares the latest financial market insights.

In a nutshell:

- Financial markets are showing a mixed picture lately, with performances differing between various regions and economic sectors.

- Selma believes that a well diversified long-term investment strategy is the only proven way to reduce risk without giving up return potential. Don’t sell in May, stay invested!

- Selma has identified some changes in market valuations. It will buy a bit more of US company shares, and reduce the portfolio shares going into company shares in Switzerland, Europe and Emerging Markets.

Markets showing a mixed picture

Recently, financial markets seem to have a lot in common with the weather. In general, the sun is still somewhat reluctant to shine. Regionally, there are quite some differences, with some places experiencing a drought, while others are flooded.

Translating this into financial markets: European company shares have done surprisingly well since fears about the banking sector health have calmed down again. But the broader US market and investments in real estate and private equity have disappointed to varying extent.

What is good for a year, may not be good for 10 years

As usual, caution is warranted when some investments appear to be better than others. Often, these temporary differences disappear or even reverse over time. The Dow Jones may have been the slightly better choice in the US market for the last 18 months, but the broader S&P 500 index outran the Dow Jones by a whopping 24% over the last 10 years.

The reason is clear: The Dow Jones includes much fewer modern technology companies. Making bets on which sector of the economy performs better in the next 12 months is not part of a successful investment strategy, in Selma’s view. Historically, trying to do so has failed just as much as trying to pick the best single companies. Selma thinks you should rather aim for the broadest possible diversification.

Sell in May and go away?

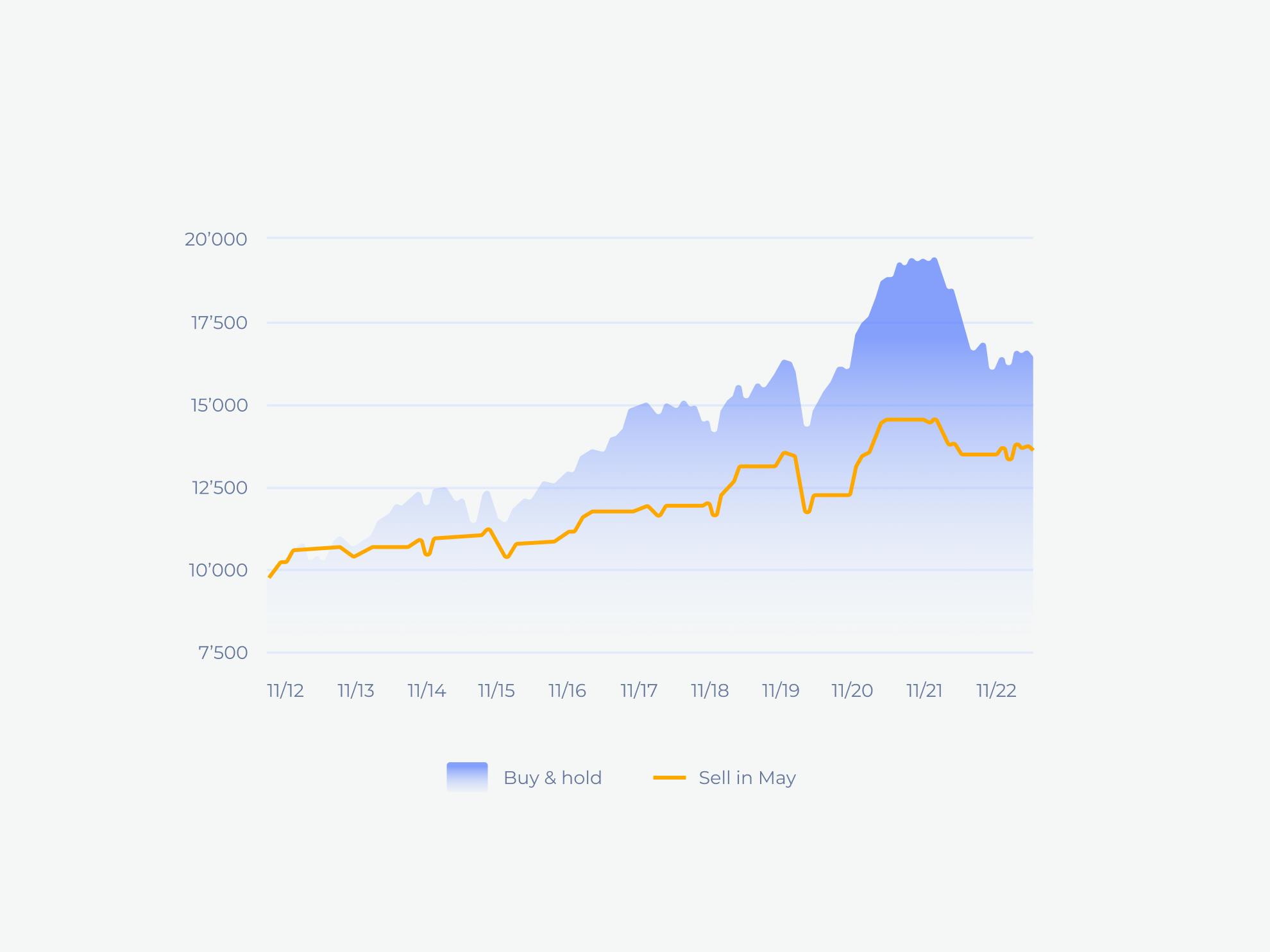

Every year investors get confronted with this question by the financial media. It is based on the observation that markets for company shares tend to perform better in the months from November till April than during May till October.

However, summarizing this observation with the words “sell in May and go away” is misleading. If company share markets perform less well during summer, then the next important question should be: what performs better? The answer is: Nothing. 🙌

As the American Corporate Finance Institute notes, “The S&P 500 typically generates positive returns roughly two-thirds of the time from May to October, while that percentage rises to 77% from November to April.” So, if you are sitting out the period May-October in cash, you are going to lose a lot of money over the long run. The chart below shows it very clearly.

Note: This model portfolio consists of three ETFs, the BlackRock iShares Core MSCI World UCITS ETF USD (Acc) and the BlackRock iShares MSCI EM UCITS ETF USD (Acc) for company shares, and the Xtrackers II Global Government Bond UCITS ETF 4C – CHF hedged for loans to countries.

Disclaimer: Past performance is no indication of future performance!

There is a shortcut

Admit it: Like every human being, you’d like to have your cake and eat it, too. 😇

Of course, it would be great to invest at a lower risk without giving up your chances for nice future returns. Guess what, this is actually possible! We’ve already written about it: “diversification”.

What is great about “diversification”?

It is often called “the only free lunch” in investing: At Selma, diversification means that you spread investments with the help of ETFs (Exchange Traded Funds) of many different companies worldwide, and even different asset classes like bonds, real-estate and precious metals. Doing so provides you with similar or better returns at much lower risk. This is because the different investments move differently, and thus can partially offset each other.

Diversification is exactly what a globally spread portfolio like Selma offers. You are not betting on one sector of the economy doing better for a year or so. You are aiming for the best return you can get for a given level of risk, over a long period of time. 🕒

How Selma addresses the current market situation

The only tactical adjustments that Selma believes make sense are those related to the over- or undervaluations of company share indices. Please note that these adjustments only apply to your investment portfolio, not your pillar 3a account.

As mentioned before, US company shares have lagged a bit behind European shares. In light of this, Selma now identifies some shift in valuations: US shares have once again become a bit more attractive compared to the recently strong-performing European and Swiss shares, but also again compared to Emerging Markets.

Therefore, Selma will now invest a bit more in US company shares, expecting them to catch up. On the other hand, a bit less will be invested in European, Swiss and Emerging Markets shares. They have now become more expensive, or, in the case of Emerging Markets, are still too expensive for the company earnings they offer.

Daniel Trum

Daniel is an economist (MSc) and financial analyst with over 10 years experience in the Swiss banking industry. He leads the investment management at Selma and he’s passionate about finding better ways to invest for everybody. Follow him on LinkedIn to get regular updates on what he thinks about financial markets.

LinkedIn