Why Selma is three times cheaper than your average Swiss bank

Ready to save some cash with Selma? Hidden fees and complex pricing make it complicated to see what one can save when looking at different money saving options.

Here is a cost comparison between Selma and a Swiss bank and the result will definitely blow your mind. With Selma, you'll be paying three times less in fees than with the bank, which means you'll be able to put more money towards your investments and watch your portfolio grow faster than ever before.

At Selma all your investments are managed for a monthly payment. The yearly fee starts fron 0.42% depending on the amount you invest with Selma. You can read more here about Selmas price.

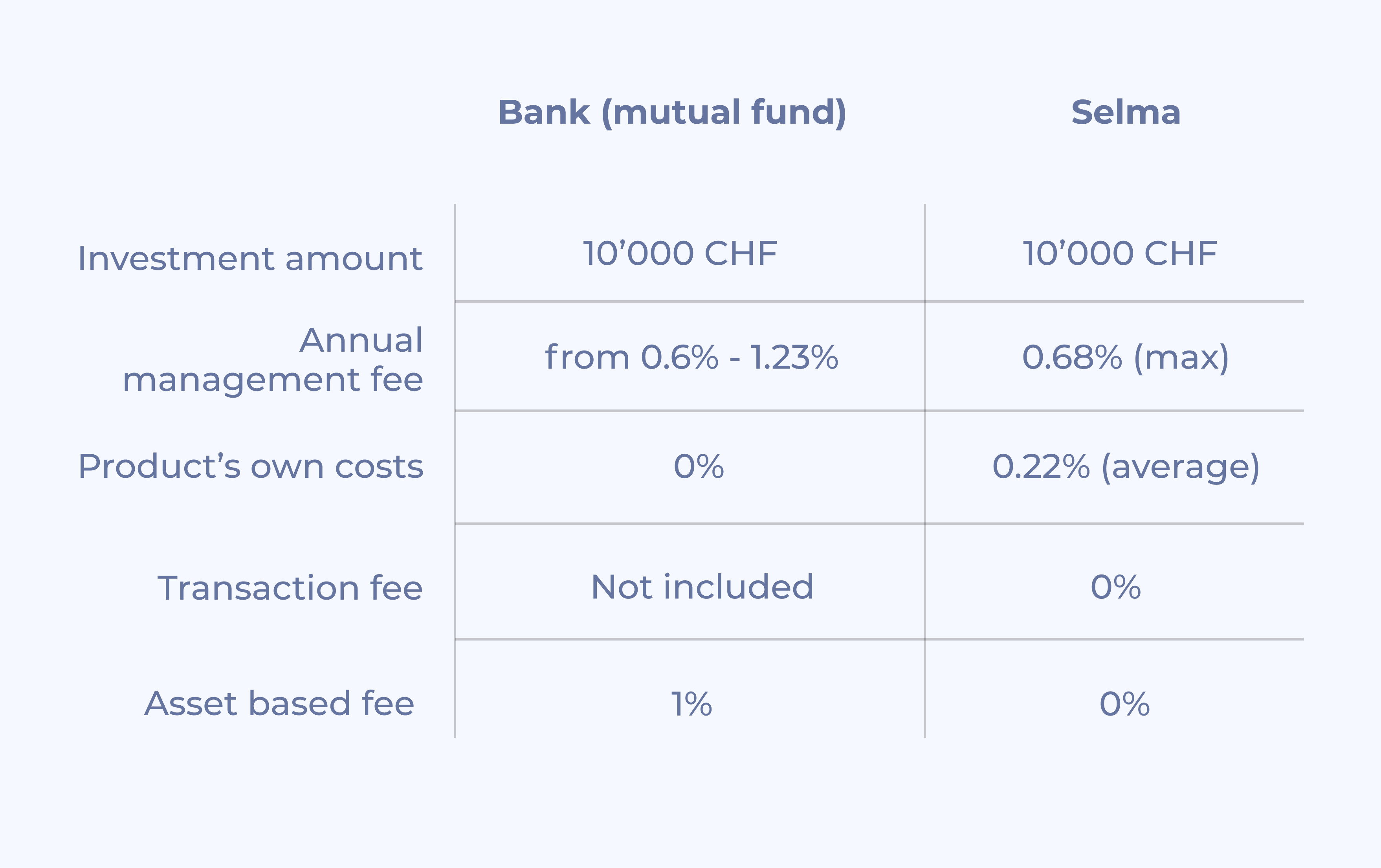

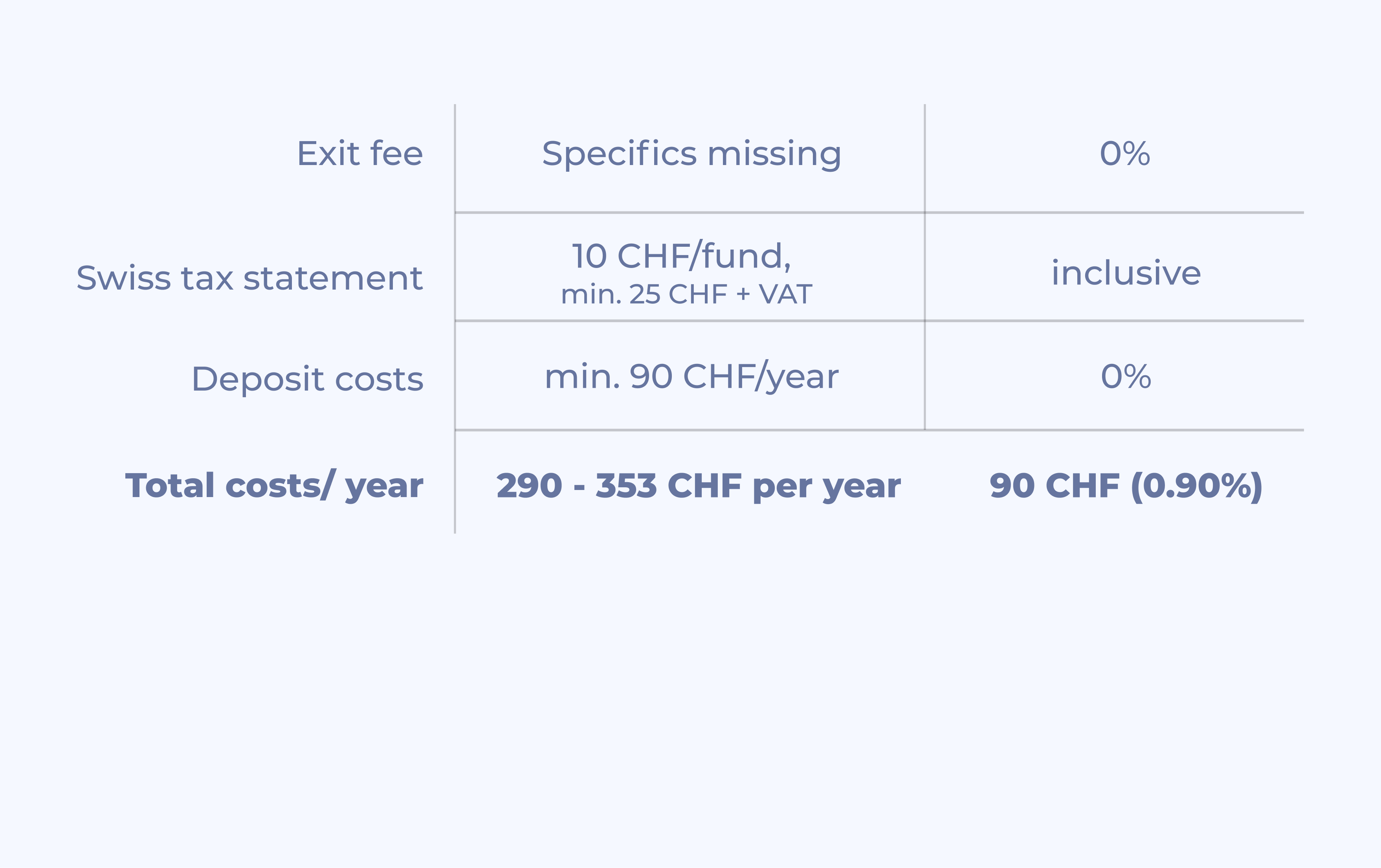

In this practical example we choose an investment amount of 10'000 CHF.

Selma is three times cheaper

These are not estimates here, but real numbers straight from the bank’s own website and fund prospectuses. (Out of courtesy, we’re not mentioning names – but their fees are sky high.)

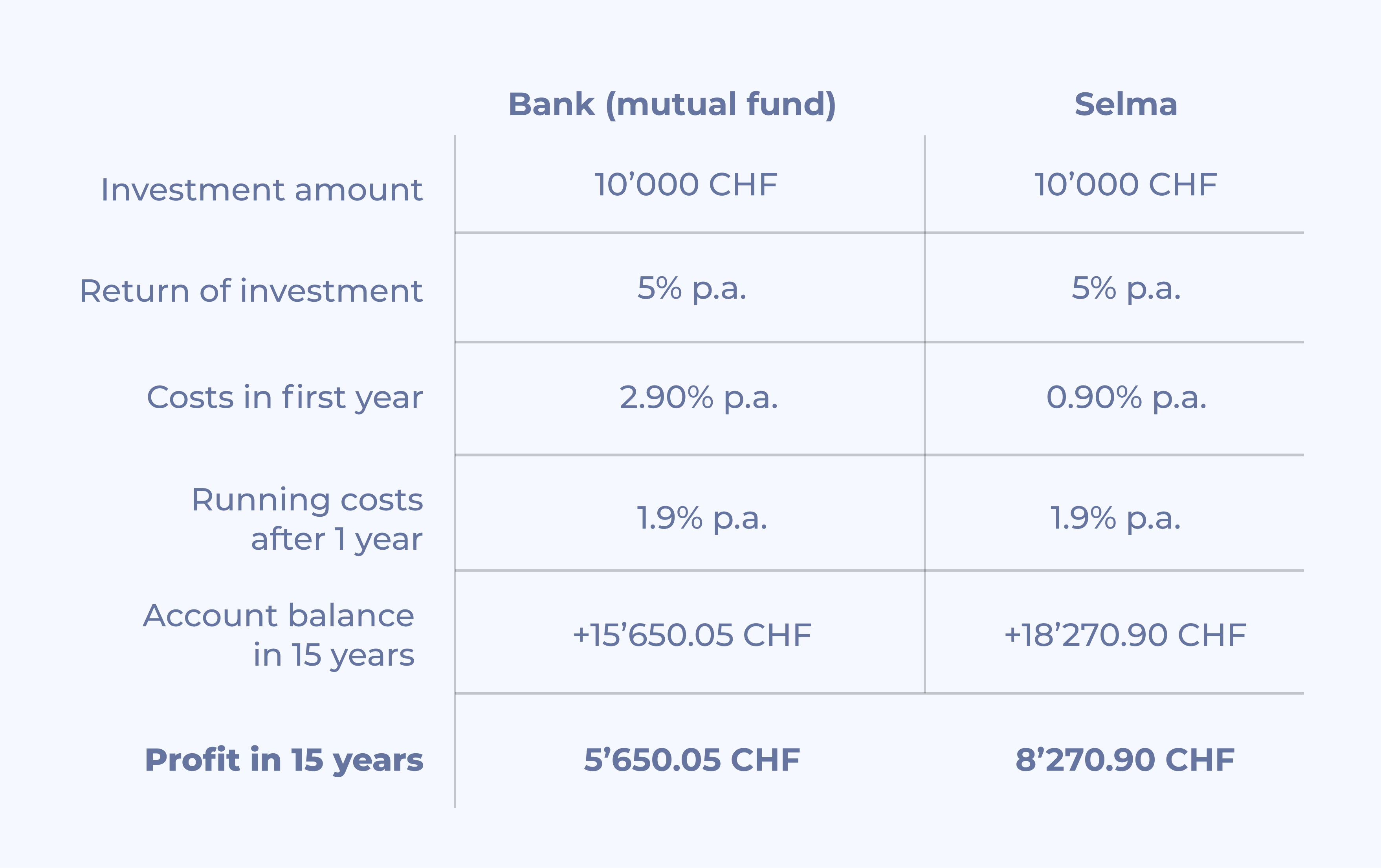

How does this look in practice?

Well, if you were to invest 10,000 CHF for 15 years and earn a stable return of 5% per year – this is what your situation would look like:

So, summarising this means with the bank you would make over 2k or 26% less profit on your initial investment than with Selma. Yikes! 😲

Thus, before you invest your hard-earned money, make sure to read the fine print and watch out for all those hidden costs. For Selma transparency is a key – try it for free and get your individual investment in just 5 minutes. Trust us, your wallet will thank you.

Sonja Egger

Sonja is a communication pro with background in Media and Intercultural Communication. She is here with the mission to keep your content varied, interesting and enjoyable. Outside of working hours Sonja is either swinging the paint brush or watching cat videos. 😺

Linkedin