Dividend portfolio: How to earn passive income

A dividend portfolio is a proven strategy for building passive income over the long term. This investment strategy is becoming increasingly important, especially in times of low interest rates and economic uncertainty. In this article, you will learn how to build your dividend portfolio. What are the 10 best dividend stocks and what are the 10 best dividend ETFs? Learn about the advantages and disadvantages of a dividend portfolio and what you should look out for.

What is a dividend portfolio?

A dividend portfolio consists of shares or ETFs from companies that regularly pay dividends. These distributions can be used as additional income or reinvested to take advantage of the compound interest effect. A well-developed dividend portfolio can generate passive income for you.

Advantages of a dividend portfolio

- Regular income: Regular income: Dividends offer a relatively stable source of income. In other words, a passive income.

- Long-term wealth accumulation: By reinvesting dividends, capital can grow significantly over the years.

- Stability: Companies with stable dividend payments are often financially sound and less volatile.

- Inflation protection: Dividends can help maintain purchasing power as they tend to rise with inflation.

Disadvantages of a dividend portfolio

- Less growth: High dividend yields can come at the expense of price growth.

- Less diversification: High-dividend sectors such as utilities or consumer goods often dominate the portfolio.

- Higher taxes: Regular distributions increase your taxable income.

- Dividends are not guaranteed: Companies can reduce or cancel dividends, especially in times of crisis.

- Manual reinvestment: With distributions, you have to actively reinvest, unlike with accumulating ETFs.

Step-by-step guide: Building a dividend portfolio

1. Define your financial goals

Think about what you want to achieve with your dividend portfolio:

- Passive income: Do you want to generate additional income?

- Goal: Are you planning for retirement?

- Risk: How much risk are you willing to take?2. Marktanalyse und Auswahl der Dividendenstrategie

2. Market analysis and selection of dividend strategy

When selecting stocks or ETFs, pay attention to the following criteria:

- Dividend yield: A measure of the profitability of the dividend in relation to the share price.

- Payout ratio: Shows how much of the profit is distributed as dividends.

- Dividend history: Companies with a stable or rising dividend history are often more reliable.

You can find an interesting example analysis here.

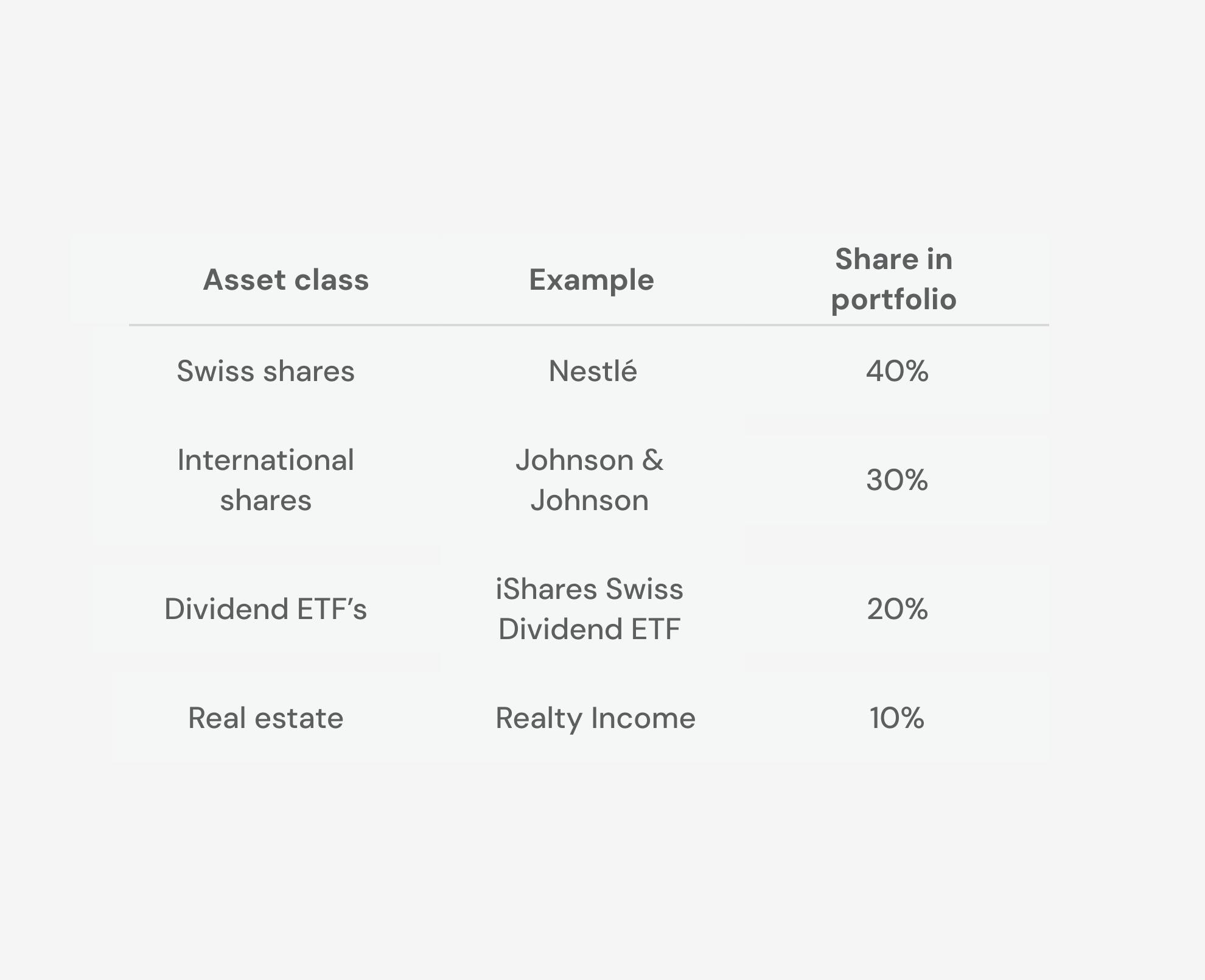

3. Diversification despite dividend stocks

Spread your investments across different sectors and regions to minimise risk. A well-diversified portfolio can better offset fluctuations. ETFs are a suitable instrument for achieving good diversification quickly and easily. However, with every ETF, pay attention to where exactly and in what proportion the money is invested; often a very large proportion is invested in the USA.

4. Regular review and adjustment

Monitor your portfolio regularly and adjust it as necessary so that you don't lose sight of your financial goals.

The best dividend stocks in 2025

Here is a list of the top 10 dividend stocks with the highest dividend yields:

- Castle Private Equity with a dividend yield of 19.62%

- Leonteq with a dividend yield of 16.56%

- Orior with a dividend yield of 15.62%

- Varia US Properties with a dividend yield of 9.76%

- EDAG Engineering with a dividend yield of 8.14%

- Mobilezone with a dividend yield of 8.67%

- Bellevue Group with a dividend yield of 8.11%

- Swisscom with a dividend yield of 7.62%

- BB Biotech with a dividend yield of 6.72%

- APG with a dividend yield of 6.21%

Note: The dividend yields shown are based on data from 2024 and may change over time. The data was collected from the following source.

The best dividend ETFs in 2025

Here is a list of the top 10 dividend stocks with the highest dividend yields:

- Global X SuperDividend® UCITS ETF D with a dividend yield of 10.67%

- iShares STOXX Global Select Dividend 100 UCITS ETF (DE) with a dividend yield of 4.77%

- SPDR S&P Global Dividend Aristocrats UCITS ETF with a dividend yield of 4.16%

- Amundi Global Equity Quality Income UCITS ETF Dist with a dividend yield of 3.94%

- VanEck Morningstar Developed Markets Dividend Leaders UCITS ETF with a dividend yield of 3.93%

- Xtrackers STOXX Global Select Dividend 100 Swap UCITS ETF 1D with a dividend yield of 3.89%

- SPDR S&P Global Dividend Aristocrats Screened UCITS ETF USD Unhedged (Dist) with a dividend yield of 3.77%

- UBS S&P Dividend Aristocrats ESG Elite UCITS ETF USD dis with a dividend yield of 3.25%

- Vanguard FTSE All-World High Dividend Yield UCITS ETF Distributing with a dividend yield of 3.13%

- iShares MSCI World Quality Dividend Advanced UCITS ETF USD (Dist) with a dividend yield of 2.56%

Note: The dividend yields shown are based on data from 2024 and may change over time. The data was collected from the following source.

How much capital is needed for a monthly dividend of CHF 1,000?

Many investors dream of passive income from dividends, for example receiving CHF 1,000 per month. Let your money work for you and live off dividends. But how much capital do you realistically need to achieve this goal?

Sample calculation: CHF 1,000 dividend per month

Target: 1,000 Swiss francs in dividends per month = 12,000 Swiss francs per year

Now it depends on the assumed average dividend yield. Here is a realistic calculation example:

Example with a 4% yield: 12,000 ÷ 0.04 = 300,000 Swiss francs

To earn CHF 12,000 per year or CHF 1,000 per month passively, you need around CHF 300,000.

Tax aspects of dividends in Switzerland

Dividends are subject to income tax in Switzerland. This means that any distributions you receive from shares or ETFs must be declared as income in your tax return, regardless of whether you reinvest the money or spend it.

Understanding withholding tax

Dividend payments from Swiss companies are subject to an additional 35% withholding tax. This serves as a control instrument for the state. The good news is that if you declare your dividends correctly in your tax return, you can reclaim the full amount of withholding tax retained.

Example:

- You receive a dividend of CHF 1,000 from Nestlé

- CHF 650 is transferred to you (65%)

- CHF 350 is withheld as withholding tax (35%)

- If you declare your dividends correctly, you will receive the CHF 350 back via your tax assessment.

You can find more information on how to correctly declare dividends on your tax return here.

Accumulating ETFs: a tax advantage?

In addition to distributing ETFs, there are also accumulating ETFs, which automatically reinvest dividends back into the fund assets. For investors looking to build up long-term wealth, these products are often easier to manage from a tax perspective. But they are not tax-free.

Advantages of reinvesting ETFs from a tax perspective:

- No ongoing distributions = no immediate cash inflow

- Simpler reinvestment without transaction costs

- Potentially lower tax complexity (especially for international ETFs)

In Switzerland, reinvested income is also generally taxable as income, even though no money flows into your account. This income is published annually by the FTA and must also be reported in your tax return.

Conclusion

Generate passive income with dividends

A well-structured dividend portfolio enables you to build up a stable passive income over the long term. With the right dividend strategy, a solid selection of stocks or ETFs, and a little patience, you can generate a steady cash flow through dividends. The key is to realistically plan your capital requirements and choose a sustainable dividend yield. Investing today means reaping the rewards tomorrow in the form of regular distributions and financial freedom.

Can you live off dividends?

In principle, it is possible to live off dividends as income in the long term with a sufficiently large dividend portfolio. The key factors here are a high capital base, a stable dividend yield and smart diversification. Dividend stocks and ETFs with reliable distributions offer particular long-term potential in this regard. However, it takes time and you need to have invested a relatively large amount of money. Those who start early and invest consistently can build up a passive income that can be used in old age or to partially finance their living expenses.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn